Question: Please explain step by step, thanks! Preparing a production cost report, second department with 43B g WIP; decision making Learning Objectives 2, 4,6 hy uses

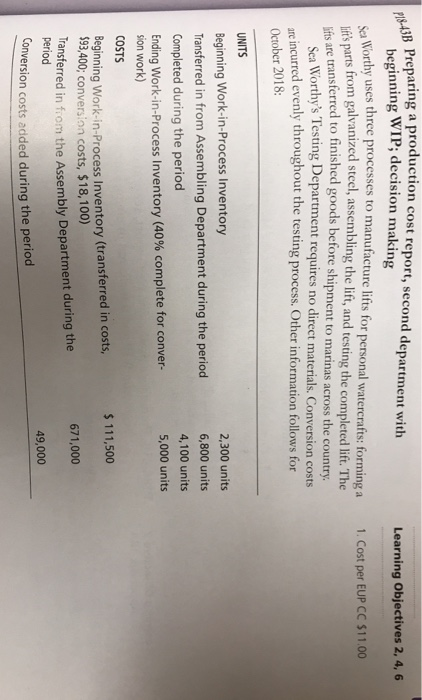

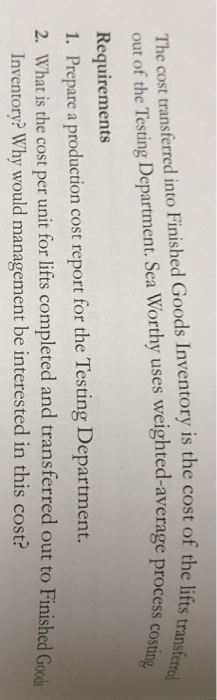

Preparing a production cost report, second department with 43B g WIP; decision making Learning Objectives 2, 4,6 hy uses three processes to manufacture lifts for personal watercrafts: forming a Wort from galvanized steel, assembling the lift, and testing the completed lift. The Cost per EUP Cc $11.00 lif's parts from transferred to finished goods before shipment to marinas across the country lifts are Sea Worthy's Testing Department requires no direct materials, Conversion costs re incurred evenly throughout the testing process. Other information follows for October 2018: UNITS Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending work-in-Process Inventory (40% complete for conver- 2,300 units 6,800 units 4,100 units 5,000 units sion work) COSTS Beginning Work-in-Process Inventory (transferred in costs $ 111,500 93,400; conversion costs, $18,100) Transferred in from the Assembly Department during the 671,000 period 49,000 Conversion costs added during the period The cost transferred into Finished Goods Inventory is the cost of the lif out of the Testing Department. Sea Worthy uses weighted-average process Requirements 1. Prepare a production cost report for the Testing Department. 2. What is the cost per unit for lifts completed and transferred out to Finished Goo erage Inventory? Why would management be interested in this cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts