Question: Please Explain Step by Step The forecast for Arctic Sled's free cash flows for next year is provided in the table. Assume that free cash

Please Explain Step by Step

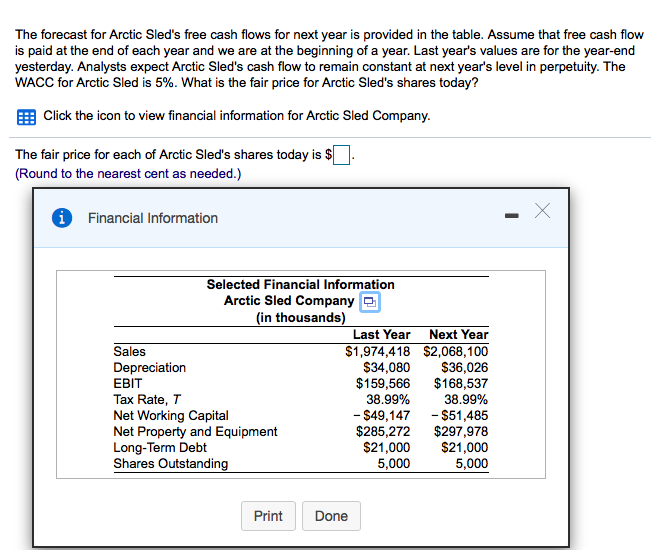

The forecast for Arctic Sled's free cash flows for next year is provided in the table. Assume that free cash flow is paid at the end of each year and we are at the beginning of a year. Last year's values are for the year-end yesterday. Analysts expect Arctic Sled's cash flow to remain constant at next year's level in perpetuity. The WACC for Arctic Sled is 5%. What is the fair price for Arctic Sled's shares today? Click the icon to view financial information for Arctic Sled Company. The fair price for each of Arctic Sled's shares today is $ (Round to the nearest cent as needed.) 0 Financial Information X Selected Financial Information Arctic Sled Company - (in thousands) Last Year Next Year Sales $1,974,418 $2,068,100 Depreciation $34,080 $36,026 EBIT $159,566 $168,537 Tax Rate, T 38.99% 38.99% Net Working Capital - $49,147 - $51,485 Net Property and Equipment $285,272 $297,978 Long-Term Debt $21,000 $21,000 Shares Outstanding 5,000 5,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts