Question: please explain step way step Interpreting and Evaluating Financial Statements Your grade will be based on: 1. All students will use the same data for

please explain step way step

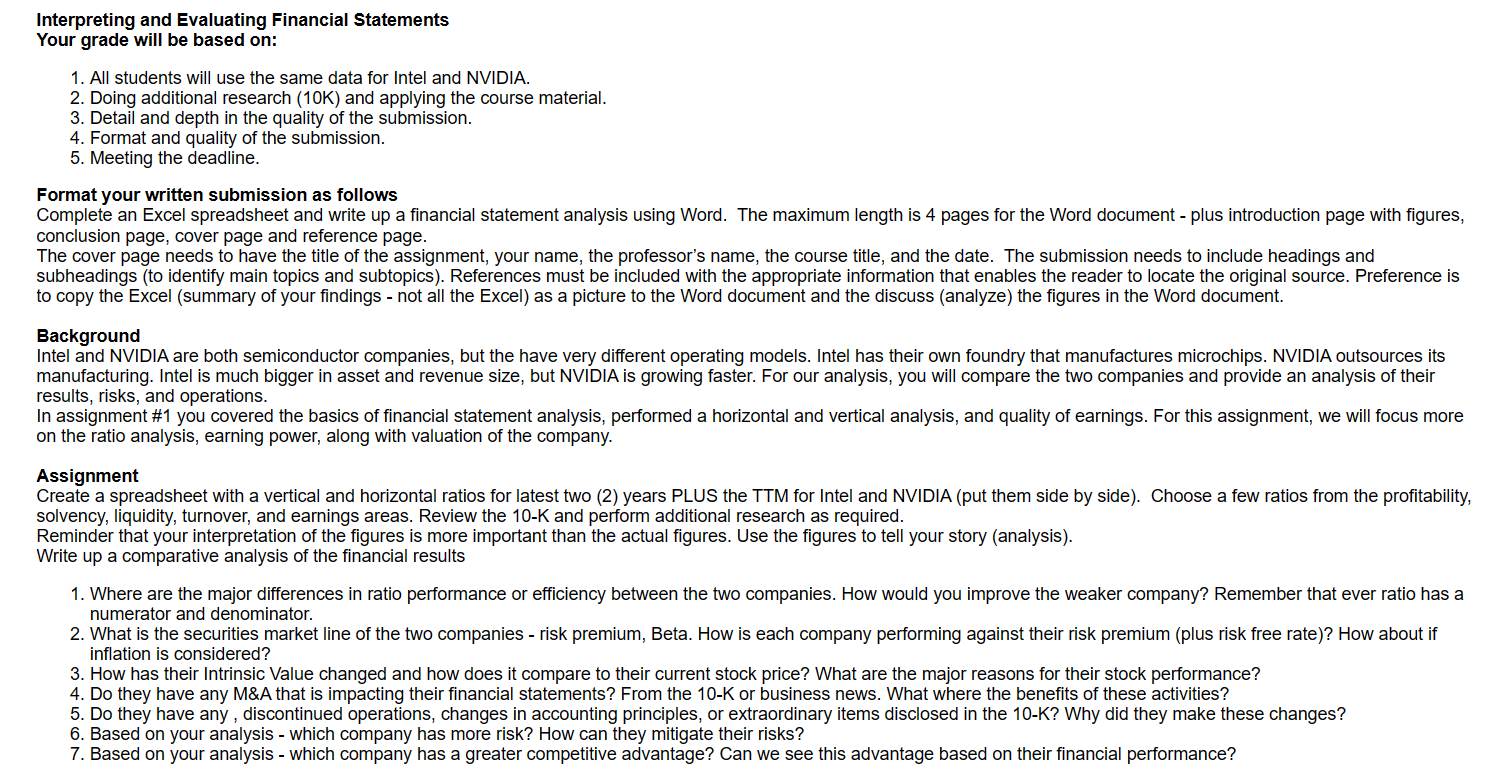

Interpreting and Evaluating Financial Statements Your grade will be based on: 1. All students will use the same data for Intel and NVIDIA. 2. Doing additional research (10K) and applying the course material. 3 . Detail and depth in the quality of the submission. 4. Format and quality of the submission. 5. Meeting the deadline. Format your written submission as follows Complete an Excel spreadsheet and write up a financial statement analysis using Word. The maximum length is 4 pages for the Word document - plus introduction page with figures, conclusion page, cover page and reference page. The cover page needs to have the title of the assignment, your name, the professor's name, the course title, and the date. The submission needs to include headings and subheadings (to identify main topics and subtopics). References must be included with the appropriate information that enables the reader to locate the original source. Preference is to copy the Excel (summary of your findings - not all the Excel) as a picture to the Word document and the discuss (analyze) the figures in the Word document. Background Intel and NVIDIA are both semiconductor companies, but the have very different operating models. Intel has their own foundry that manufactures microchips. NVIDIA outsources its manufacturing. Intel is much bigger in asset and revenue size, but NVIDIA is growing faster. For our analysis, you will compare the two companies and provide an analysis of their results, risks, and operations. In assignment \#1 you covered the basics of financial statement analysis, performed a horizontal and vertical analysis, and quality of earnings. For this assignment, we will focus more on the ratio analysis, earning power, along with valuation of the company. Assignment Create a spreadsheet with a vertical and horizontal ratios for latest two (2) years PLUS the TTM for Intel and NVIDIA (put them side by side). Choose a few ratios from the profitability, solvency, liquidity, turnover, and earnings areas. Review the 10K and perform additional research as required. Reminder that your interpretation of the figures is more important than the actual figures. Use the figures to tell your story (analysis). Write up a comparative analysis of the financial results 1. Where are the major differences in ratio performance or efficiency between the two companies. How would you improve the weaker company? Remember that ever ratio has a numerator and denominator. 2. What is the securities market line of the two companies - risk premium, Beta. How is each company performing against their risk premium (plus risk free rate)? How about if inflation is considered? 3. How has their Intrinsic Value changed and how does it compare to their current stock price? What are the major reasons for their stock performance? 4. Do they have any M\&A that is impacting their financial statements? From the 10-K or business news. What where the benefits of these activities? 5. Do they have any, discontinued operations, changes in accounting principles, or extraordinary items disclosed in the 10-K? Why did they make these changes? 6. Based on your analysis - which company has more risk? How can they mitigate their risks? 7. Based on your analysis - which company has a greater competitive advantage? Can we see this advantage based on their financial performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts