Question: Please explain steps for all, thank you! Use the data for Starbucks (SBUX) and Google (GOOG) to answer the following questions: a. What is the

Please explain steps for all, thank you!

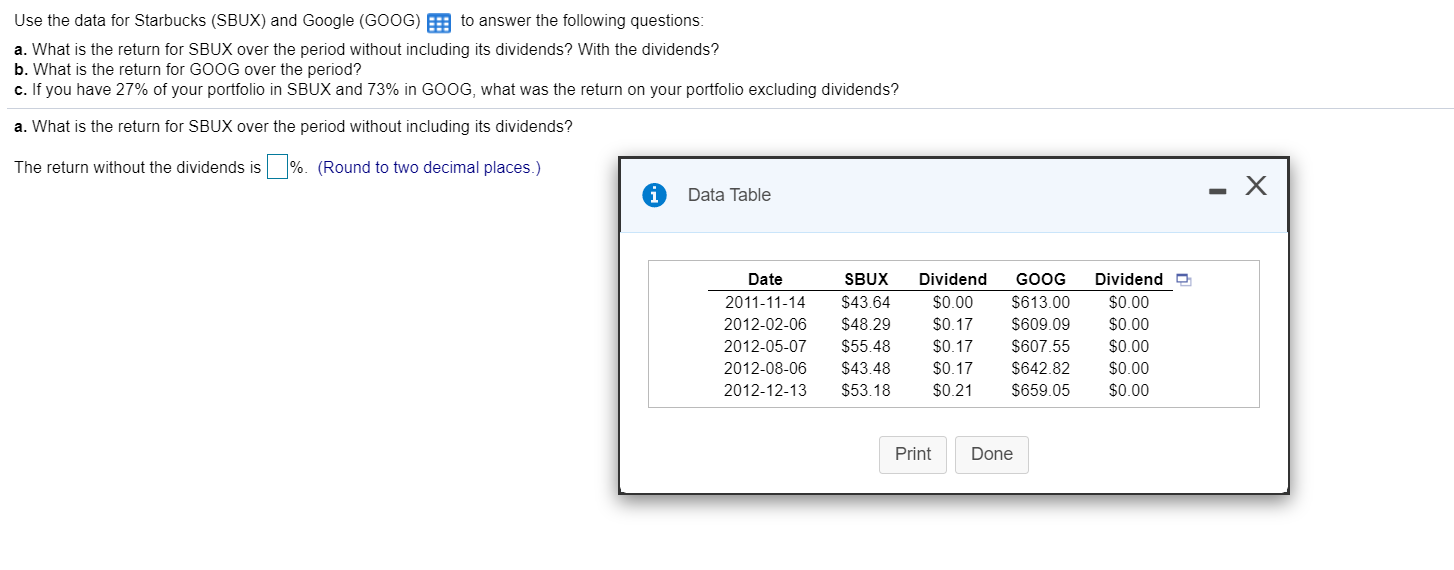

Use the data for Starbucks (SBUX) and Google (GOOG) to answer the following questions: a. What is the return for SBUX over the period without including its dividends? With the dividends? b. What is the return for GOOG over the period? c. If you have 27% of your portfolio in SBUX and 73% in GOOG, what was the return on your portfolio excluding dividends? a. What is the return for SBUX over the period without including its dividends? The return without the dividends is %. (Round to two decimal places.) * Data Table - X Date 2011-11-14 2012-02-06 2012-05-07 2012-08-06 2012-12-13 SBUX $43.64 $48.29 $55.48 $43.48 $53.18 Dividend $0.00 $0.17 $0.17 $0.17 $0.21 GOOGDividend $613.00 $0.00 $609.09 $0.00 $607.55 $0.00 $642.82 $0.00 $659.05 $0.00 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts