Question: please explain steps I'm confused Instructions: You will use Excel (or another spreadsheet application) to create proforma income statements and cash flow projections for a

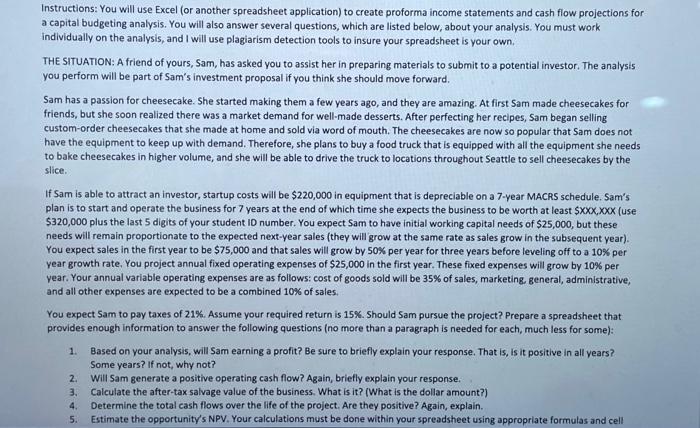

Instructions: You will use Excel (or another spreadsheet application) to create proforma income statements and cash flow projections for a capital budgeting analysis. You will also answer several questions, which are listed below, about your analysis. You must work individually on the analysis, and I will use plagiarism detection tools to insure your spreadsheet is your own. THE SITUATION: A friend of yours, Sam, has asked you to assist her in preparing materials to submit to a potential investor. The analysis you perform will be part of Sam's investment proposal if you think she should move forward. Sam has a passion for cheesecake. She started making them a few years ago, and they are amazing. At first Sam made cheesecakes for friends, but she soon realized there was a market demand for well-made desserts. After perfecting her recipes, Sam began selling custom-order cheesecakes that she made at home and sold via word of mouth. The cheesecakes are now so popular that Sam does not have the equipment to keep up with demand. Therefore, she plans to buy a food truck that is equipped with all the equipment she needs to bake cheesecakes in higher volume, and she will be able to drive the truck to locations throughout Seattle to sell cheesecakes by the slice. If Sam is able to attract an investor, startup costs will be $220,000 in equipment that is depreciable on a 7-year MACRS schedule. Sam's plan is to start and operate the business for 7 years at the end of which time she expects the business to be worth at least $XXX,XXXX (use $320,000 plus the last 5 digits of your student ID number. You expect Sam to have initial working capital needs of $25,000, but these needs will remain proportionate to the expected next-year sales (they will grow at the same rate as sales grow in the subsequent year). You expect sales in the first year to be $75,000 and that sales will grow by 50% per year for three years before leveling off to a 10% per year growth rate, You project annual fixed operating expenses of $25,000 in the first year. These fixed expenses will grow by 10% per year. Your annual variable operating expenses are as follows: cost of goods sold will be 35% of sales, marketing. general, administrative, and all other expenses are expected to be a combined 10% of sales. You expect Sam to pay taxes of 21%. Assume your required return is 15%. Should Sam pursue the project? Prepare a spreadsheet that provides enough information to answer the following questions (no more than a paragraph is needed for each, much less for some): 1. Based on your analysis, will Sam earning a profit? Be sure to briefly explain your response. That is, is it positive in all years? Some years? If not, why not? 2. Will Sam generate a positive operating cash flow? Again, briefly explain your response. 3. Calculate the after-tax salvage value of the business. What is it? (What is the dollar amount?) 4. Determine the total cash flows over the life of the project. Are they positive? Again, explain. 5. Estimate the opportunity's NPV. Your calculations must be done within your spreadsheet using appropriate formulas and cell Instructions: You will use Excel (or another spreadsheet application) to create proforma income statements and cash flow projections for a capital budgeting analysis. You will also answer several questions, which are listed below, about your analysis. You must work individually on the analysis, and I will use plagiarism detection tools to insure your spreadsheet is your own. THE SITUATION: A friend of yours, Sam, has asked you to assist her in preparing materials to submit to a potential investor. The analysis you perform will be part of Sam's investment proposal if you think she should move forward. Sam has a passion for cheesecake. She started making them a few years ago, and they are amazing. At first Sam made cheesecakes for friends, but she soon realized there was a market demand for well-made desserts. After perfecting her recipes, Sam began selling custom-order cheesecakes that she made at home and sold via word of mouth. The cheesecakes are now so popular that Sam does not have the equipment to keep up with demand. Therefore, she plans to buy a food truck that is equipped with all the equipment she needs to bake cheesecakes in higher volume, and she will be able to drive the truck to locations throughout Seattle to sell cheesecakes by the slice. If Sam is able to attract an investor, startup costs will be $220,000 in equipment that is depreciable on a 7-year MACRS schedule. Sam's plan is to start and operate the business for 7 years at the end of which time she expects the business to be worth at least $XXX,XXXX (use $320,000 plus the last 5 digits of your student ID number. You expect Sam to have initial working capital needs of $25,000, but these needs will remain proportionate to the expected next-year sales (they will grow at the same rate as sales grow in the subsequent year). You expect sales in the first year to be $75,000 and that sales will grow by 50% per year for three years before leveling off to a 10% per year growth rate, You project annual fixed operating expenses of $25,000 in the first year. These fixed expenses will grow by 10% per year. Your annual variable operating expenses are as follows: cost of goods sold will be 35% of sales, marketing. general, administrative, and all other expenses are expected to be a combined 10% of sales. You expect Sam to pay taxes of 21%. Assume your required return is 15%. Should Sam pursue the project? Prepare a spreadsheet that provides enough information to answer the following questions (no more than a paragraph is needed for each, much less for some): 1. Based on your analysis, will Sam earning a profit? Be sure to briefly explain your response. That is, is it positive in all years? Some years? If not, why not? 2. Will Sam generate a positive operating cash flow? Again, briefly explain your response. 3. Calculate the after-tax salvage value of the business. What is it? (What is the dollar amount?) 4. Determine the total cash flows over the life of the project. Are they positive? Again, explain. 5. Estimate the opportunity's NPV. Your calculations must be done within your spreadsheet using appropriate formulas and cell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts