Question: Please explain. Thanks Incorrect Question 12 0/1 pts Mr. and Mrs. Long provided over one-half of the total support during 2019 of the following individuals:

Please explain. Thanks

Please explain. Thanks

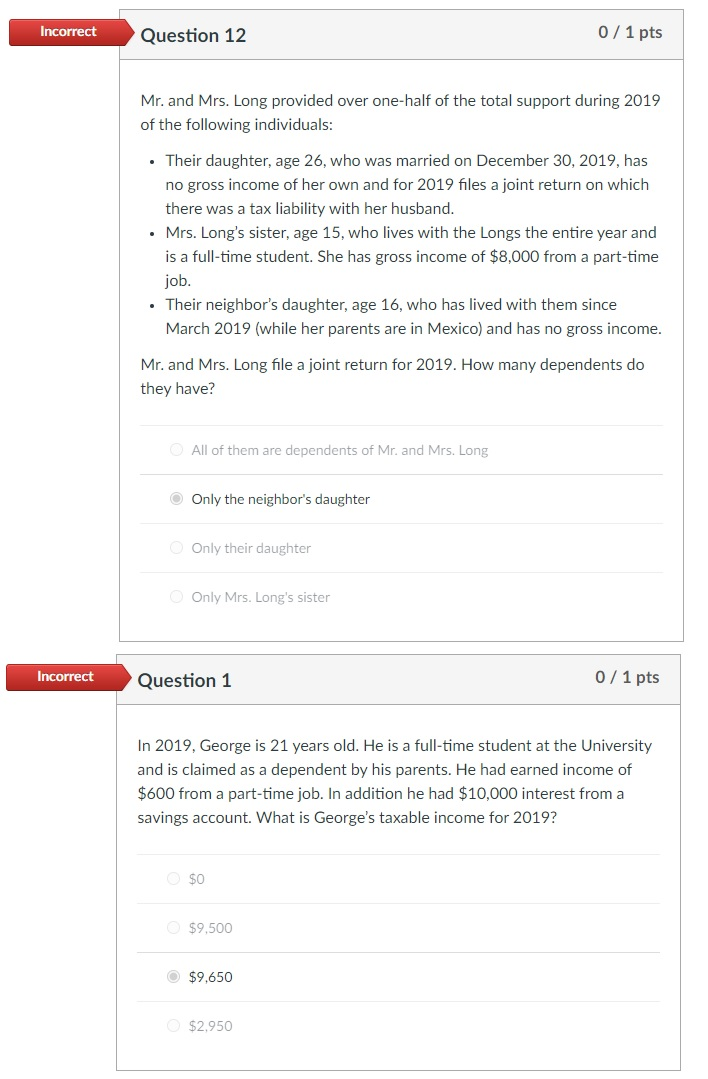

Incorrect Question 12 0/1 pts Mr. and Mrs. Long provided over one-half of the total support during 2019 of the following individuals: Their daughter, age 26, who was married on December 30, 2019, has no gross income of her own and for 2019 files a joint return on which there was a tax liability with her husband. Mrs. Long's sister, age 15, who lives with the Longs the entire year and is a full-time student. She has gross income of $8,000 from a part-time job. Their neighbor's daughter, age 16, who has lived with them since March 2019 (while her parents are in Mexico) and has no gross income. Mr. and Mrs. Long file a joint return for 2019. How many dependents do they have? All of them are dependents of Mr. and Mrs. Long Only the neighbor's daughter Only their daughter Only Mrs. Long's sister Incorrect Question 1 0 / 1 pts In 2019, George is 21 years old. He is a full-time student at the University and is claimed as a dependent by his parents. He had earned income of $600 from a part-time job. In addition he had $10,000 interest from a savings account. What is George's taxable income for 2019? $0 $9,500 $9,650 $2.950

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts