Question: please explain. thanks Problems - to get full credit you need to show all your work and supporting calculations. 15. Dougan Company purchased equipment on

please explain. thanks

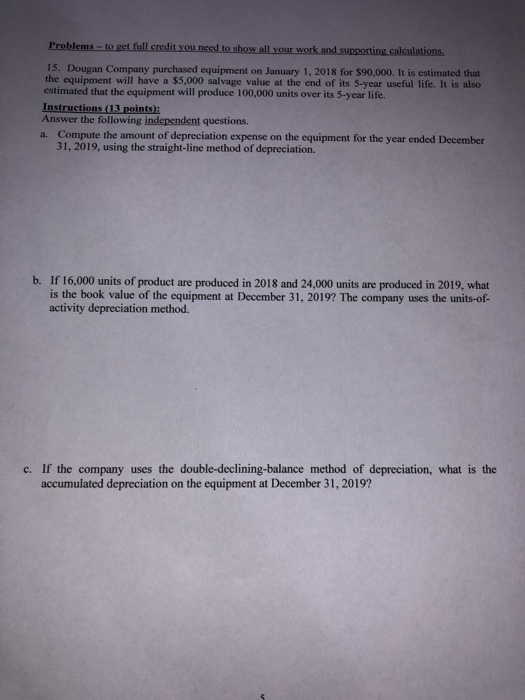

please explain. thanks Problems - to get full credit you need to show all your work and supporting calculations. 15. Dougan Company purchased equipment on January 1, 2018 for $90,000. It is estimated that the equipment will have a $5,000 salvage value at the end of its 5-year useful life. It is also estimated that the equipment will produce 100,000 units over its 5-year life. Instructions (13 points) Answer the following independent questions. a. Compute the amount of depreciation expense on the equipment for the year ended December 31, 2019, using the straight-line method of depreciation. b. If 16,000 units of product are produced in 2018 and 24.000 units are produced in 2019, what is the book value of the equipment at December 31, 2019? The company uses the units-of- activity depreciation method. c. If the company uses the double-declining-balance method of depreciation, what is the accumulated depreciation on the equipment at December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts