Question: Please explain the answer and provide the excel function Question 2: What price should Blue Algae obtain if the pool is sold immediately to an

Please explain the answer and provide the excel function

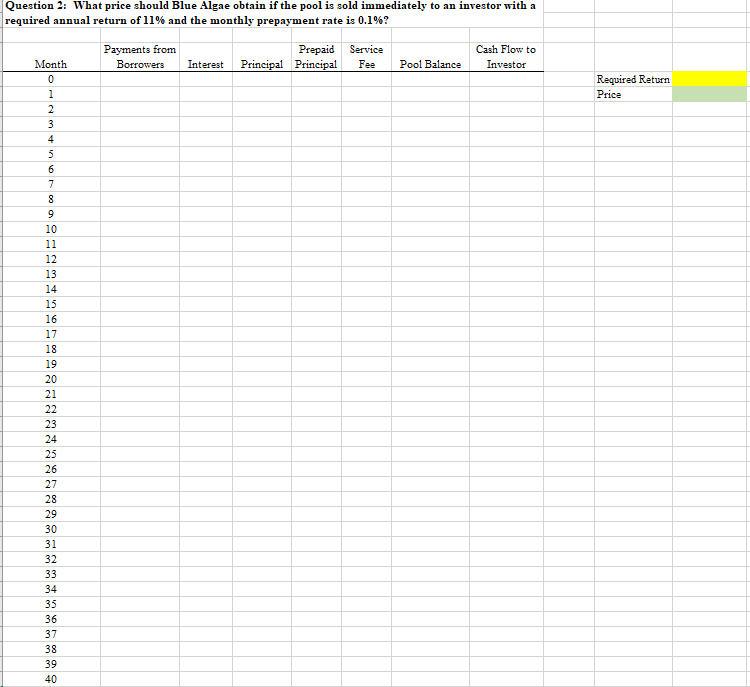

Question 2: What price should Blue Algae obtain if the pool is sold immediately to an investor with a required annual return of 11% and the monthly prepayment rate is 0.1%? Service Payments from Borrowers Prepaid Interest Principal Principal Cash Flow to Investor Fee Pool Balance Required Return Price Month 0 1 2 3 4 5 6 7 00 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Question 2: What price should Blue Algae obtain if the pool is sold immediately to an investor with a required annual return of 11% and the monthly prepayment rate is 0.1%? Service Payments from Borrowers Prepaid Interest Principal Principal Cash Flow to Investor Fee Pool Balance Required Return Price Month 0 1 2 3 4 5 6 7 00 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts