Question: Please Explain the Answer Clearly! Puddle Enterprises is evaluating the purchase of an elaborate hydraulic lift system for all of its locations to use for

Please Explain the Answer Clearly!

Please Explain the Answer Clearly!

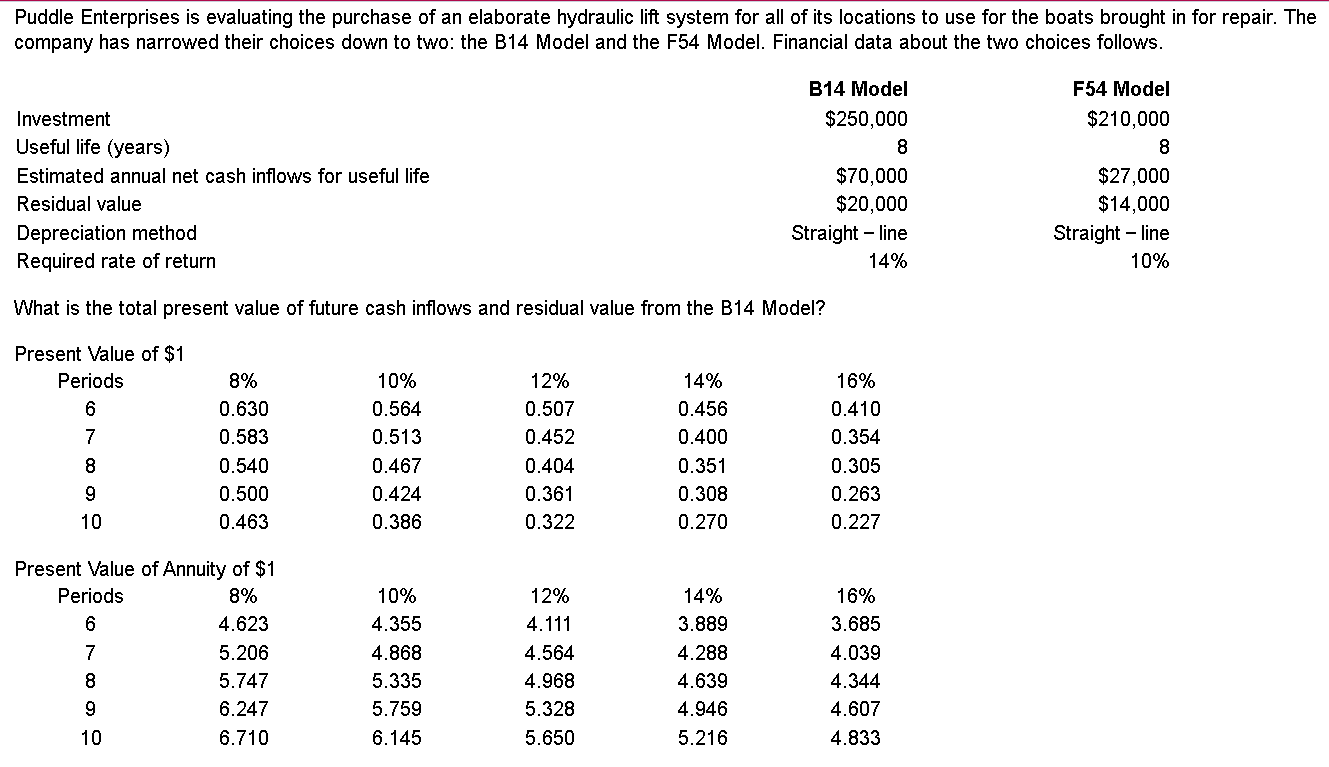

Puddle Enterprises is evaluating the purchase of an elaborate hydraulic lift system for all of its locations to use for the boats brought in for repair. The company has narrowed their choices down to two: the B14 Model and the F54 Model. Financial data about the two choices follows. Investment Useful life (years) Estimated annual net cash inflows for useful life Residual value Depreciation method Required rate of return 9 10 What is the total present value of future cash inflows and residual value from the B14 Model? Present Value of $1 Periods 6 7 8 Present Value of Annuity of $1 8% 4.623 5.206 5.747 6.247 6.710 Periods 26 8% 0.630 0.583 0.540 0.500 0.463 9 10 10% 0.564 0.513 0.467 0.424 0.386 10% 4.355 4.868 5.335 5.759 6.145 12% 0.507 0.452 0.404 0.361 0.322 12% 4.111 4.564 4.968 5.328 5.650 14% 0.456 0.400 0.351 0.308 0.270 B14 Model $250,000 14% 3.889 4.288 4.639 4.946 5.216 8 $70,000 $20,000 Straight-line 14% 16% 0.410 0.354 0.305 0.263 0.227 16% 3.685 4.039 4.344 4.607 4.833 F54 Model $210,000 8 $27,000 $14,000 Straight-line 10% A. $150,583 B. $81,750 C. $340,000 D. $331,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts