Question: Please explain the answer in simple form. Problem The growth in dividends of XYZ, Inc. is expected to be 10% per year for the next

Please explain the answer in simple form.

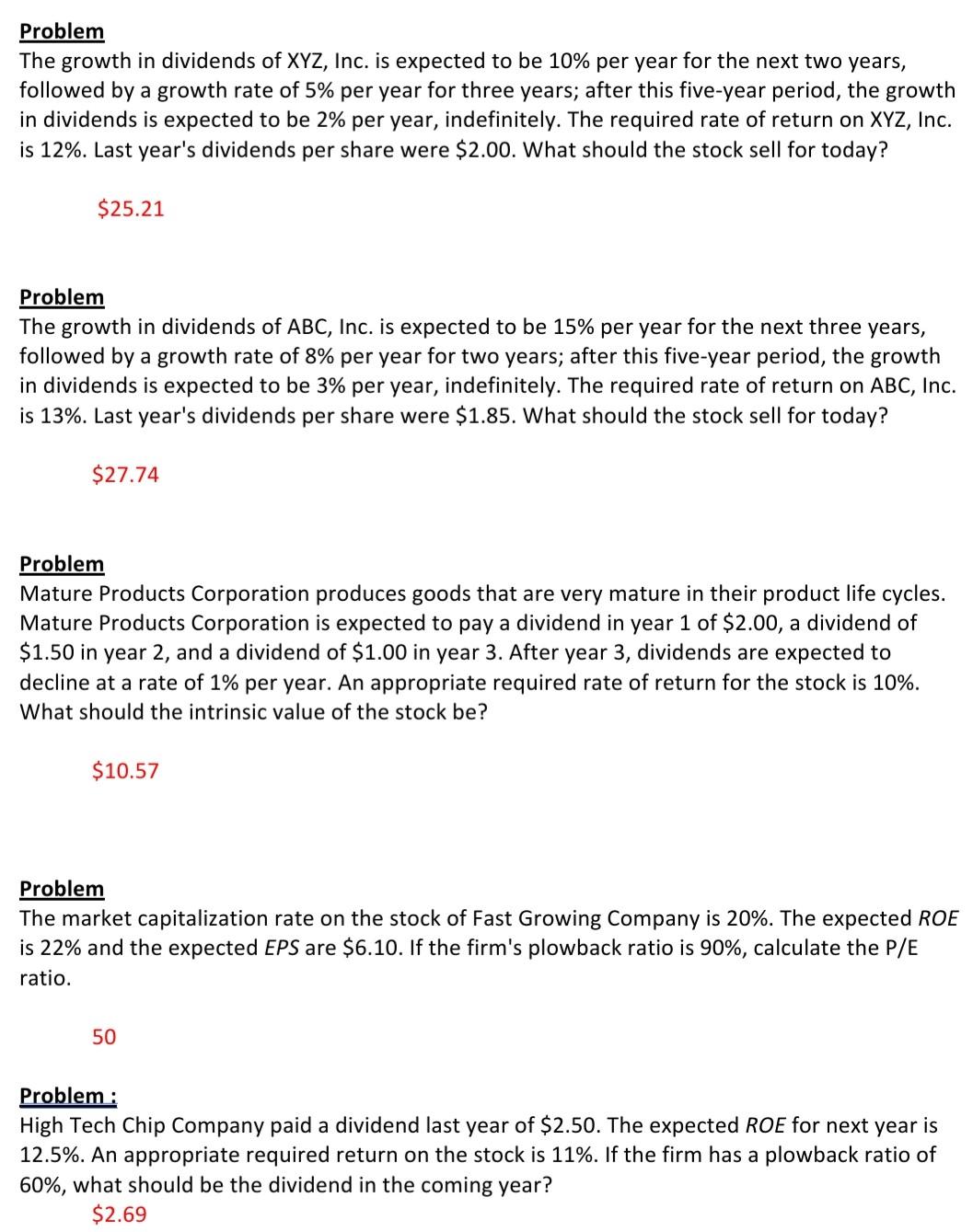

Problem The growth in dividends of XYZ, Inc. is expected to be 10% per year for the next two years, followed by a growth rate of 5% per year for three years; after this five-year period, the growth in dividends is expected to be 2% per year, indefinitely. The required rate of return on XYZ, Inc. is 12%. Last year's dividends per share were $2.00. What should the stock sell for today? $25.21 Problem The growth in dividends of ABC, Inc. is expected to be 15% per year for the next three years, followed by a growth rate of 8% per year for two years; after this five-year period, the growth in dividends is expected to be 3% per year, indefinitely. The required rate of return on ABC, Inc. is 13%. Last year's dividends per share were $1.85. What should the stock sell for today? $27.74 Problem Mature Products Corporation produces goods that are very mature in their product life cycles. Mature Products Corporation is expected to pay a dividend in year 1 of $2.00, a dividend of $1.50 in year 2, and a dividend of $1.00 in year 3. After year 3, dividends are expected to decline at a rate of 1% per year. An appropriate required rate of return for the stock is 10%. What should the intrinsic value of the stock be? $10.57 Problem The market capitalization rate on the stock of Fast Growing Company is 20%. The expected ROE is 22% and the expected EPS are $6.10. If the firm's plowback ratio is 90%, calculate the P/E ratio. 50 Problem: High Tech Chip Company paid a dividend last year of $2.50. The expected ROE for next year is 12.5%. An appropriate required return on the stock is 11%. If the firm has a plowback ratio of 60%, what should be the dividend in the coming year? $2.69

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts