Question: Please explain the answer or steps. Thank you. 19. You purchased a 5-year annual interest coupon bond one year ago. Its coupon interest rate was

Please explain the answer or steps. Thank you.

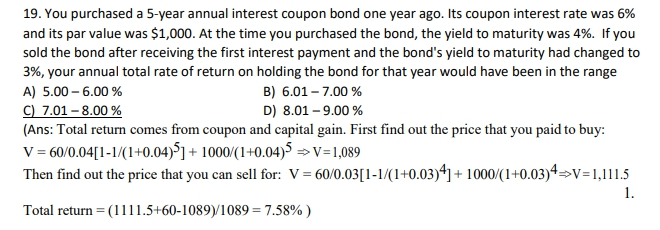

19. You purchased a 5-year annual interest coupon bond one year ago. Its coupon interest rate was 6% and its par value was $1,000. At the time you purchased the bond, the yield to maturity was 4%. If you sold the bond after receiving the first interest payment and the bond's yield to maturity had changed to 3%, your annual total rate of return on holding the bond for that year would have been in the range B) 6.01-7.00 % D) 8.01-9.00 % A) 5.00-6.00 % C) 7.01-8.00 % Ans: Total returm comes from coupon and capital gain. First find out the price that you paid to buy V 60/0.04[1-1/(1+0.04)5]+1000/(I+0.04)5V-1,089 Then find out the price that you can sell for: V= 60/0.03[1-1/(1+0.03)4] + 1000/(1+0.03)4-1,111.5 Total return = ( 1 1 1 1.5+60-1089)/1089 = 7.58% )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts