Question: Please explain the answer or steps. Thank you. 21. You write a call option with X S55 and buy a call with X $65. The

Please explain the answer or steps. Thank you.

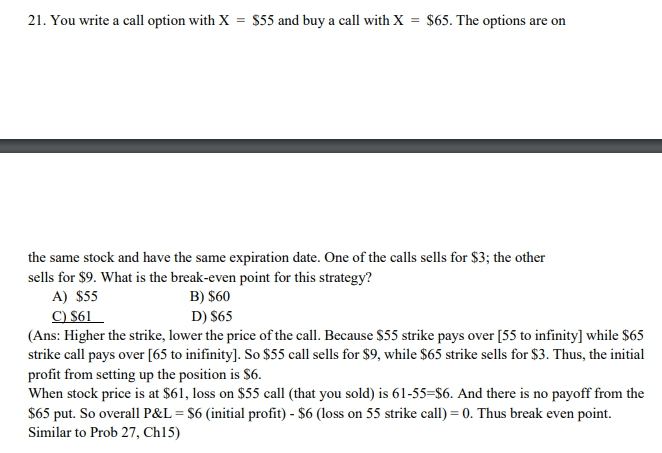

21. You write a call option with X S55 and buy a call with X $65. The options are on the same stock and have the same expiration date. One of the calls sells for $3; the other sells for $9. What is the break-even point for this strategy? A) $55 B) $60 CS61 (Ans: Higher the strike, lower the price of the call. Because S55 strike pays over [55 to infinity] while $65 strike call pays over [65 to inifinity]. So $55 call sells for $9, while $65 strike sells for $3. Thus, the initial profit from setting up the position is S6. When stock price is at S61, loss on $55 call (that you sold) is 61-55-$6. And there is no payoff from the $65 put. So overall P&L S6 (initial profit) - S6 (loss on 55 strike call) 0. Thus break even point. Similar to Prob 27, Chl5) D) S65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts