Question: please explain the answers 19. Mario purchased stock last year as fllows: Ionth arch ul etober Shares 100 200 600 Total Cost S27 60 Sl,20

please explain the answers

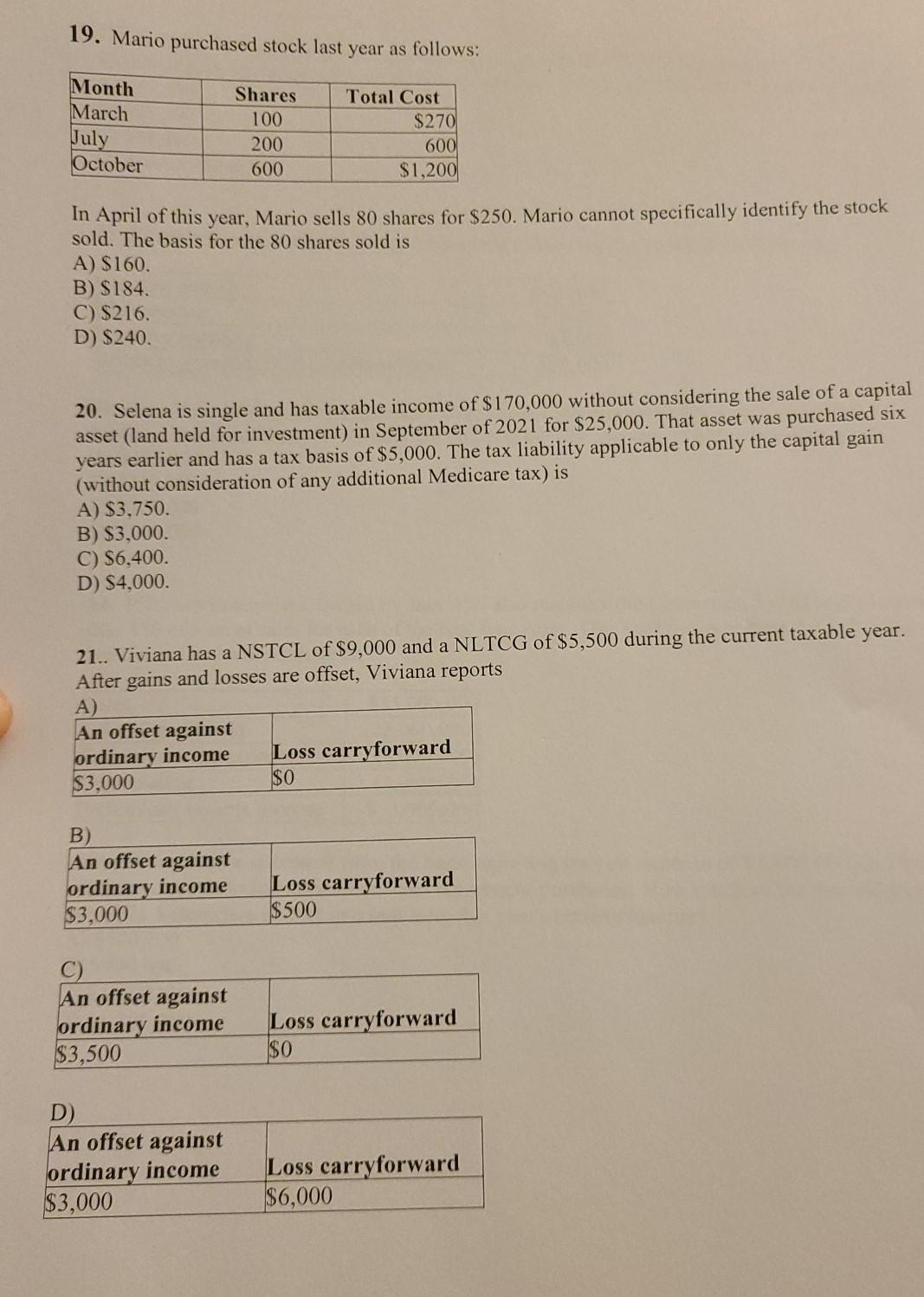

19. Mario purchased stock last year as fllows: Ionth arch ul etober Shares 100 200 600 Total Cost S27 60 Sl,20 In April of this year, Mario sells 80 shares for S250. Mario cannot specifically identify the stock sold. The basis for the 80 shares sold is A) S160. C) S216. D) S240. 20. Selena is single and has taxable income of Sl 70,000 without considering the sale of a capital asset (land held for investment) in September of 2021 for $25,000. That asset was purchased six years earlier and has a tax basis of $5,000. The tax liability applicable to only the capital gain (without consideration of any additional Medicare tax) is A) S3.750. B) S3,ooo. C) S6,400. D) S4.ooo. 21.. Viviana has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year. After gains and losses are offset, Viviana reports offset against rdina income 3,000 B) n offset against rdina income 3,000 n offset against rdina income 3,500 D) n offset against rdinar income 3,000 oss car 0 oss car 500 oss car 0 orward orward forward Loss carr forward 6,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts