Question: Please explain the answers II. Capital structure & leverage (Session 485) Tittee (Submission in Excel only) Currently, GameStop Ltd has a capital structure consisting of

Please explain the answers

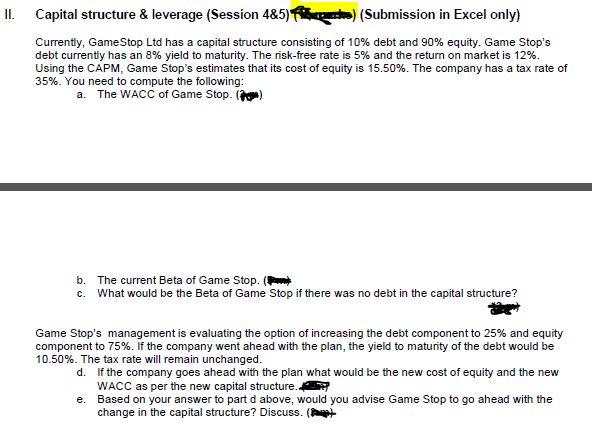

II. Capital structure & leverage (Session 485) Tittee (Submission in Excel only) Currently, GameStop Ltd has a capital structure consisting of 10% debt and 90% equity. Game Stop's debt currently has an 8% yield to maturity. The risk-free rate is 5% and the return on market is 12%. Using the CAPM, Game Stop's estimates that its cost of equity is 15.50%. The company has a tax rate of 35%. You need to compute the following: a. The WACC of Game Stop. (om) b. The current Beta of Game Stop. ( c. What would be the Beta of Game Stop if there was no debt in the capital structure? Game Stop's management is evaluating the option of increasing the debt component to 25% and equity component to 75%. If the company went ahead with the plan, the yield to maturity of the debt would be 10.50%. The tax rate will remain unchanged. d. If the company goes ahead with the plan what would be the new cost of equity and the new WACC as per the new capital structure.. e. Based on your answer to part d above, would you advise Game Stop to go ahead with the change in the capital structure? Discuss. (A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts