Question: PLease explain the calculate for buildings and equipment Problem 3-19 (Algo) (LO 3-3a) Chapman Company obtains 100 percent of Abernethy Company's stock on January 1,

PLease explain the calculate for buildings and equipment

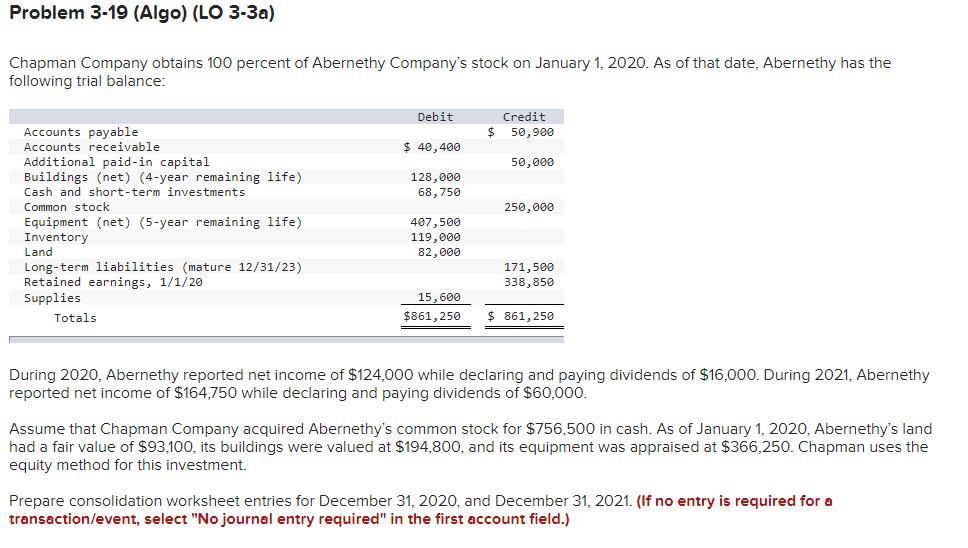

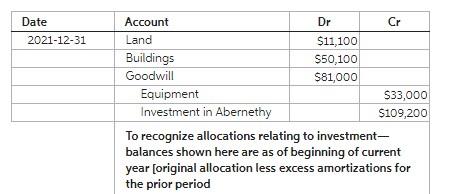

Problem 3-19 (Algo) (LO 3-3a) Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2020. As of that date, Abernethy has the following trial balance: During 2020, Abernethy reported net income of $124,000 while declaring and paying dividends of $16,000. During 2021 , Abernethy reported net income of $164,750 while declaring and paying dividends of $60,000. Assume that Chapman Company acquired Abernethy's common stock for $756,500 in cash. As of January 1,2020 , Abernethy's land had a fair value of $93,100, its buildings were valued at $194,800, and its equipment was appraised at $366,250. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2020, and December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) \begin{tabular}{|l|l|r|r|} \hline Date & Account & \multicolumn{1}{|c|}{ Dr } & \multicolumn{1}{c|}{Cr} \\ \hline 20211231 & Land & $11,100 & \\ \hline & Buildings & $50,100 & \\ \hline & Goodwill & $81,000 & \\ \hline & Equipment & & $33,000 \\ \hline & Investment in Abernethy & & $109,200 \\ \hline \end{tabular} To recognize allocations relating to investmentbalances shown here are as of beginning of current year [original allocation less excess amortizations for the prior period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts