Question: please explain the calculation of present value and the numbeer 3.6048? how did they get please explain brefily 14. Gregory Ltd enters into a non

please explain the calculation of present value and the numbeer 3.6048? how did they get please explain brefily

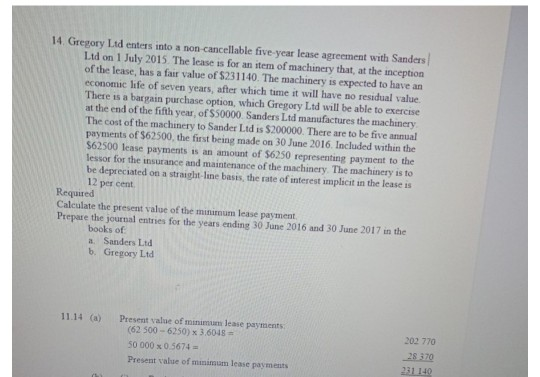

14. Gregory Ltd enters into a non cancellable five-year lease agreement with Sanders Ltd on 1 July 2015. The lease is for an item of machinery that, at the inception of the lease, has a fair value of $231140. The machinery is expected to have an economic life of seven years, after which time it will have no residual value. There is a bargain purchase option, which Gregory Ltd will be able to exercise at the end of the fifth year, of $50000 Sanders Ltd manufactures the machinery The cost of the machinery to Sander Ltd is $200000. There are to be five annual payments of $62500, the first being made on 30 June 2016. Included within the $62500 lease payments is an amount of $6250 representing payment to the lessor for the insurance and maintenance of the machinery. The machinery is to be depreciated on a straight-line basis, the rate of interest implicit in the lease is 12 per cent Required Calculate the present value of the minimum lease payment Prepare the journal entries for the years ending 30 June 2016 and 30 June 2017 in the books of a. Sanders Ltd b. Gregory Ltd 11.14 (a) Present value of minimum lease payments (62 500-6250) x 3.6048 50 000 x 0 5674 Present value of minimum lease payments 202 770 28 370 231140

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts