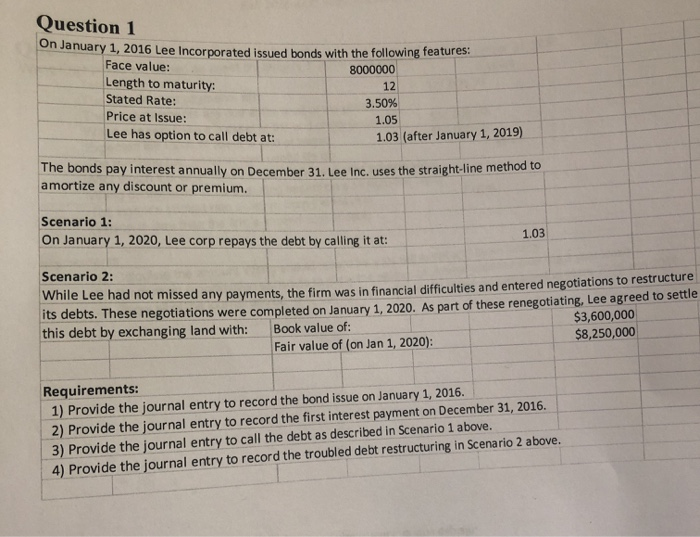

Question: please explain the calculation! Question 1 on January 1, 2016 Lee Incorporated issued bonds with the following features: Face value: 8000000 Length to maturity: Stated

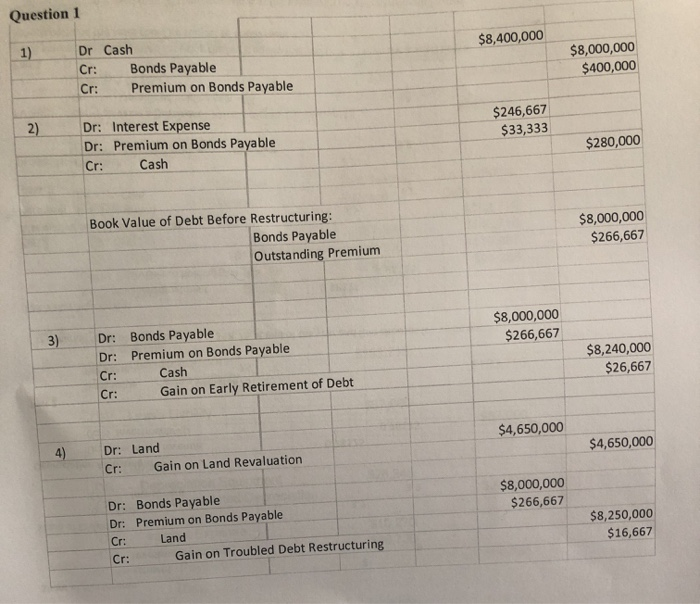

Question 1 on January 1, 2016 Lee Incorporated issued bonds with the following features: Face value: 8000000 Length to maturity: Stated Rate: 3.50% Price at Issue: 1.05 Lee has option to call debt at: 1.03 (after January 1, 2019) The bonds pay interest annually on December 31. Lee Inc. uses the straight-line methou amortize any discount or premium. Scenario 1: On January 1, 2020, Lee corp repays the debt by calling it at: 1.03 Scenario 2: While Lee had not missed any payments, the firm was in financial difficulties and entered negotiations to restructure Tts debts. These negotiations were completed on January 1.2020. As part of these renegotiating, Lee agreed to settle, this debt by exchanging land with: Book value of: $3,600,000 $8,250,000 Fair value of (on Jan 1, 2020): Requirements: 1) Provide the journal entry to record the bond issue on January 1, 2016. 2) Provide the journal entry to record the first interest payment on December 31, 2016. 3) Provide the journal entry to call the debt as described in Scenario 1 above. 4) Provide the journal entry to record the troubled debt restructuring in Scenario 2 above. Question 1 $8,400,000 1) Dr Cash Cr: Bonds Payable Cr: Premium on Bonds Payable $8,000,000 $400,000 $246,667 $33,333 Dr: Interest Expense Dr: Premium on Bonds Payable Cr: Cash $280,000 Book Value of Debt Before Restructuring: Bonds Payable Outstanding Premium $8,000,000 $266,667 $8,000,000 $266,667 3) Dr: Bonds Payable Dr: Premium on Bonds Payable Cr: Cash Cr: Gain on Early Retirement of Debt $8,240,000 $26,667 $4,650,000 4) $4,650,000 Dr: Land Cr: Gain on Land Revaluation $8,000,000 $266,667 Dr: Bonds Payable Dr: Premium on Bonds Payable Cr: Land Cr: Gain on Troubled Debt Restructuring $8,250,000 $16,667

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts