Question: Please explain the Excel function you used in detail. Question 1: a) Suppose that we want to have a yearly income of $60,000 in retirement.

Please explain the Excel function you used in detail.

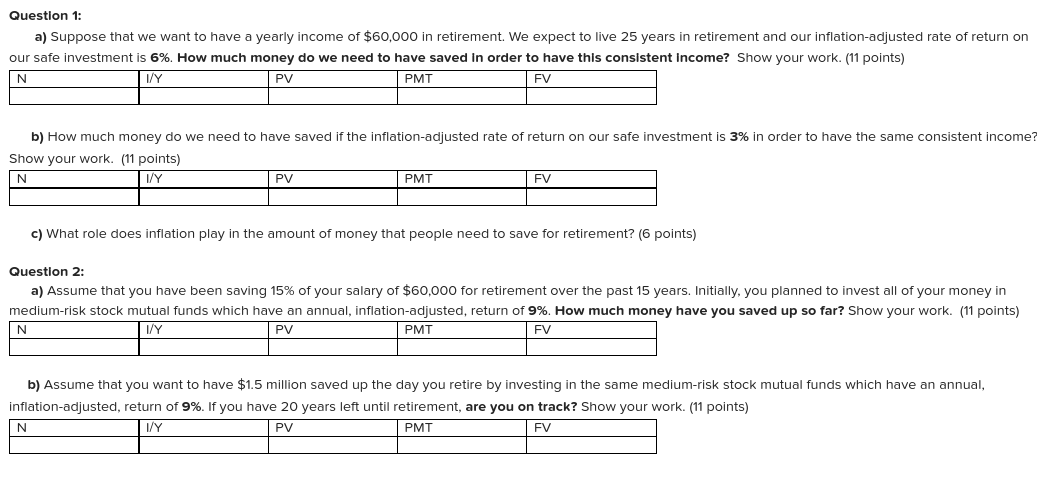

Question 1: a) Suppose that we want to have a yearly income of $60,000 in retirement. We expect to live 25 years in retirement and our inflation-adjusted rate of return on our safe investment is 6%. How much money do we need to have saved in order to have this consistent income? Show your work. (11 points) 1/Y PV PMT FV N b) How much money do we need to have saved if the inflation-adjusted rate of return on our safe investment is 3% in order to have the same consistent income? Show your work. (11 points) N 1/Y PV PMT FV c) What role does inflation play in the amount of money that people need to save for retirement? (6 points) Question 2: a) Assume that you have been saving 15% of your salary of $60,000 for retirement over the past 15 years. Initially, you planned to invest all of your money in medium-risk stock mutual funds which have an annual, inflation-adjusted, return of 9%. How much money have you saved up so far? Show your work. (11 points) N 1/Y PV PMT FV b) Assume that you want to have $1.5 million saved up the day you retire by investing in the same medium-risk stock mutual funds which have an annual, inflation-adjusted, return of 9%. If you have 20 years left until retirement, are you on track? Show your work. (11 points) N 1/ PV PMT FV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts