Question: Please explain the excel functions needed to solve both of the problems. Thanks! 5. Company X has an expected dividend of $2.00/share. The required return

Please explain the excel functions needed to solve both of the problems. Thanks!

5. Company X has an expected dividend of $2.00/share. The required return is 10% per year. What is the implied growth rate of dividends if the stock is selling at $50.00/share?

6.

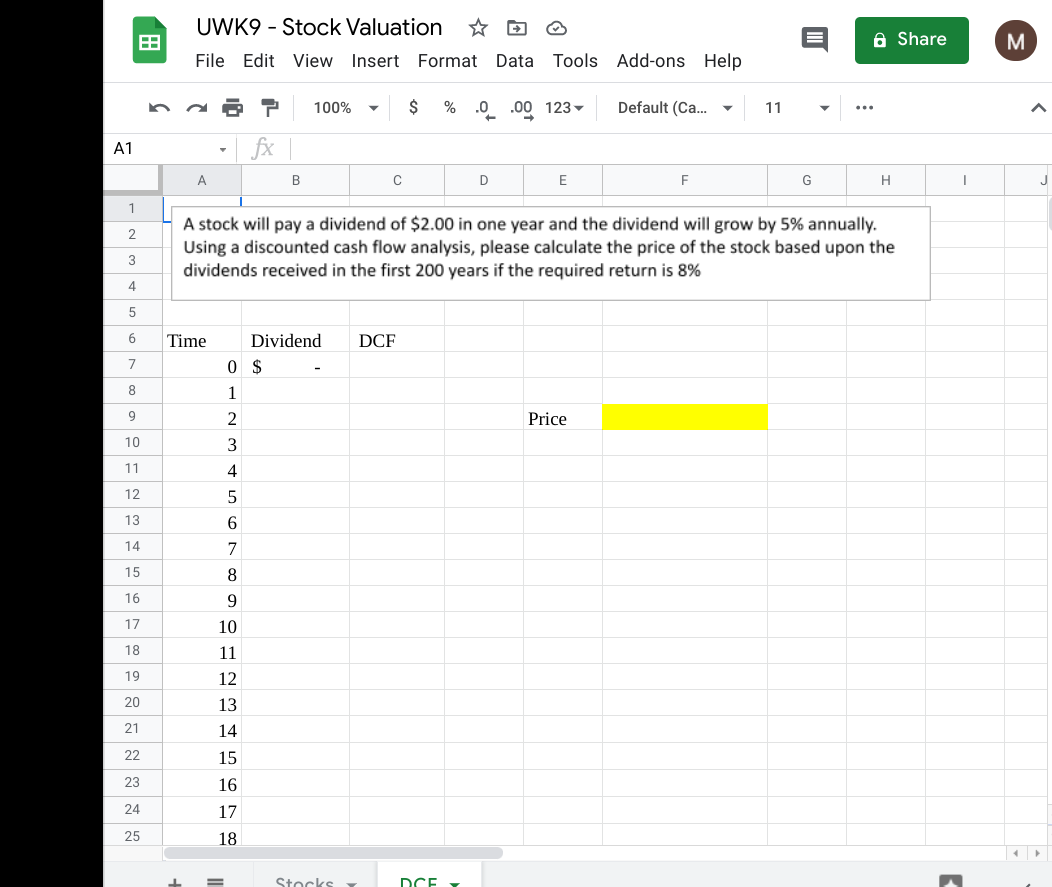

3 UWK9 - Stock Valuation File Edit View Insert Format Data Tools Add-ons Help Share M 100% $ % 0.00 123- Default (Ca... - 11 ... A1 fx B D E F G H 1 j 1 2 A stock will pay a dividend of $2.00 in one year and the dividend will grow by 5% annually. Using a discounted cash flow analysis, please calculate the price of the stock based upon the dividends received in the first 200 years if the required return is 8% 3 4 5 6 Time Dividend DCF 7 0 $ 8 1 2 9 Price 10 3 11 4 12 5 13 6 14 7 15 8 16 9 17 10 18 11 19 12 20 13 21 14 22 15 23 16 24 17 25 18 Stocks DCE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts