Question: Please explain the logic behind why the different formula (for present value) was used for both questions. Thank you. 1. Correct answer: B The first

Please explain the logic behind why the different formula (for present value) was used for both questions. Thank you.

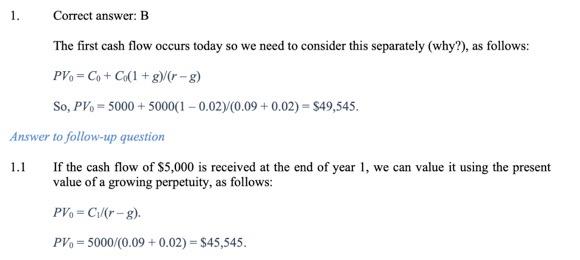

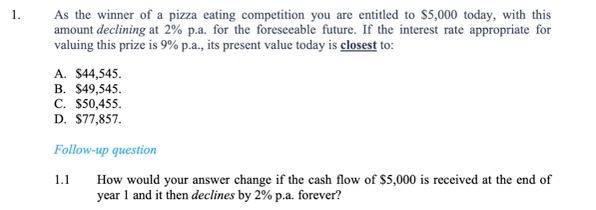

1. Correct answer: B The first cash flow occurs today so we need to consider this separately (why?), as follows: PV, = Co + C (1 + g)/(r-g) So, PV = 5000 + 5000(1 -0.02)/(0.09 +0.02) = $49,545. Answer to follow-up question 1.1 If the cash flow of $5,000 is received at the end of year 1, we can value it using the present value of a growing perpetuity, as follows: PV - C/r-g). PV = 5000/(0.09 +0.02) = $45,545. 1. As the winner of a pizza eating competition you are entitled to $5,000 today, with this amount declining at 2% p.a. for the foreseeable future. If the interest rate appropriate for valuing this prize is 9% p.a., its present value today is closest to: A. $44,545. B. $49,545. C. $50,455. D. $77,857. Follow-up question How would your answer change if the cash flow of $5,000 is received at the end of year 1 and it then declines by 2% p.a. forever

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts