Question: please explain the math behind this one Fully vested incentive stock options for 68,000 shares of common stock at an exercise price of $58 were

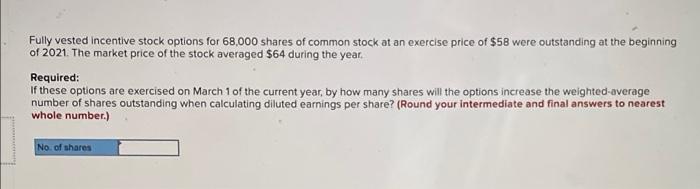

Fully vested incentive stock options for 68,000 shares of common stock at an exercise price of $58 were outstanding at the beginning of 2021 The market price of the stock averaged $64 during the year Required: If these options are exercised on March 1 of the current year, by how many shares will the options increase the weighted average number of shares outstanding when calculating diluted earnings per share? (Round your intermediate and final answers to nearest whole number.) No. of shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts