Question: PLEASE EXPLAIN THE PROCESS AND ANSWER, THERE ARE SO MANY DIFFERENT ANSWER IN CHEGG Question 5 Bond A has a coupon rate of 9%, with

PLEASE EXPLAIN THE PROCESS AND ANSWER, THERE ARE SO MANY DIFFERENT ANSWER IN CHEGG

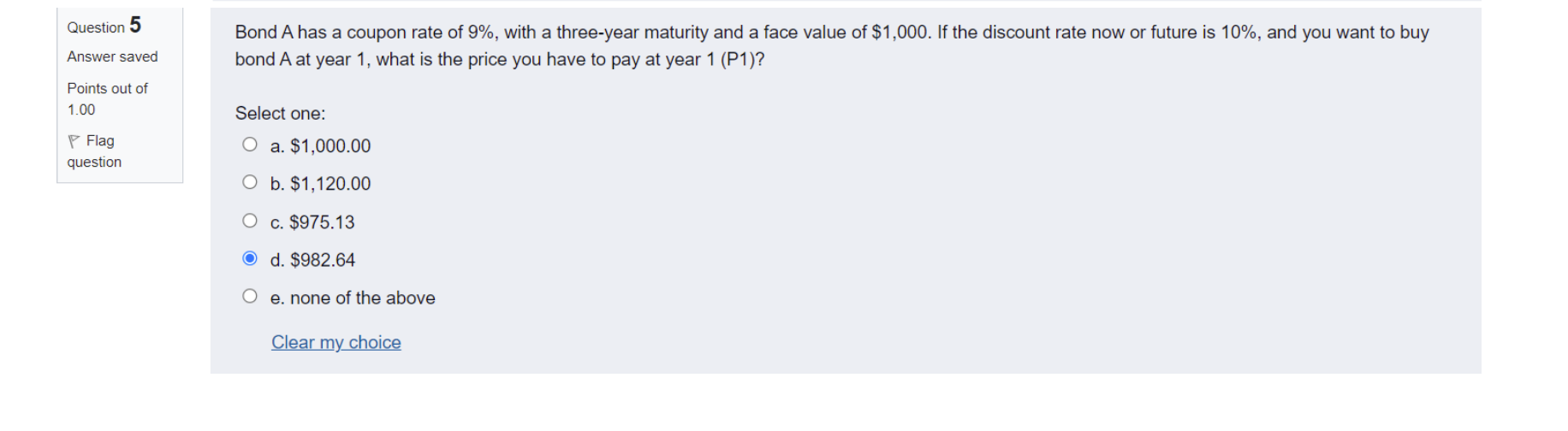

Question 5 Bond A has a coupon rate of 9%, with a three-year maturity and a face value of $1,000. If the discount rate now or future is 10%, and you want to buy bond A at year 1, what is the price you have to pay at year 1 (P1)? Answer saved Points out of 1.00 Select one: P Flag question O a. $1,000.00 O b. $1,120.00 O c. $975.13 O d. $982.64 O e. none of the above Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts