Question: Please explain the reason to this answer A fixed-income analyst has made the following assessments: The real risk-free rate is expected to remain at 2.5%

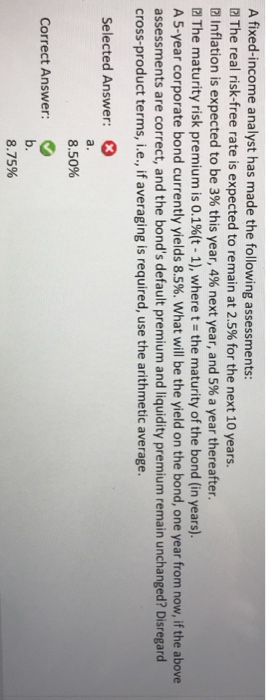

A fixed-income analyst has made the following assessments: The real risk-free rate is expected to remain at 2.5% for the next 10 years. Inflation is expected to be 3% this year, 4% next year, and 5% a year thereafter. The maturity risk premium is 0.1%(t-1), where t = the maturity of the bond (in years). A 5-year corporate bond currently yields 8.5%. What will be the yield on the bond, one year from now, if the above assessments are correct, and the bond's default premium and liquidity premium remain unchanged? Disregard cross-product terms, i.e., if averaging is required, use the arithmetic average. Selected Answer: 8.50% Correct Answer: 8.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts