Question: Please explain the red. FNCE4040-Fall2017-Final- A Initials: 2You are considering entering an FRA with your bank to borrow $8,000,000. The FRA will start in 125

Please explain the red.

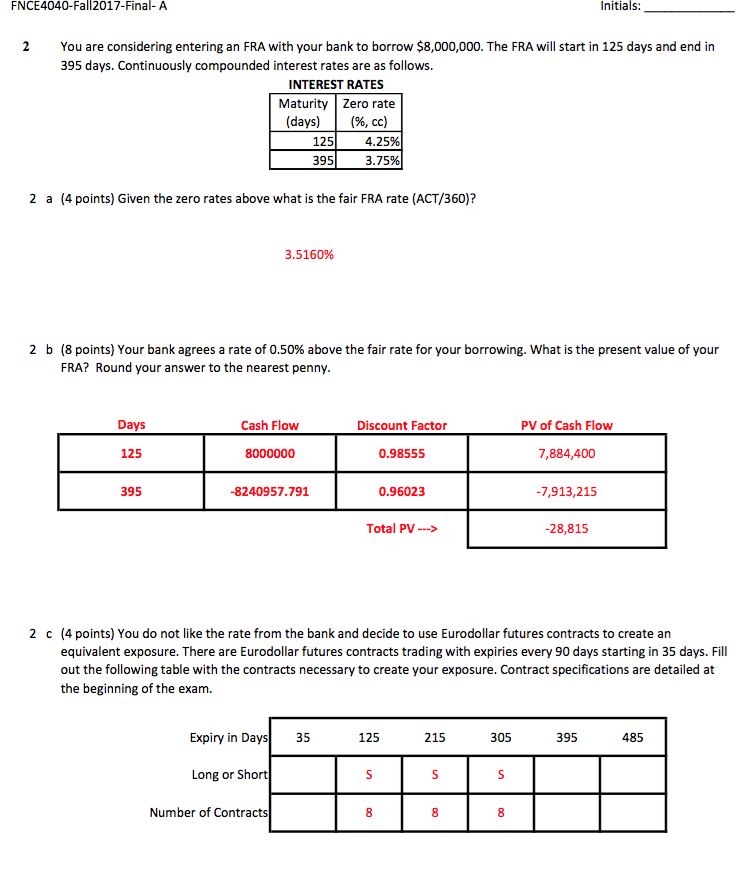

FNCE4040-Fall2017-Final- A Initials: 2You are considering entering an FRA with your bank to borrow $8,000,000. The FRA will start in 125 days and end in 395 days. Continuously compounded interest rates are as follows. INTEREST RATES aturity Zero rate (days) | (96, cc) 125 395 4.25% 3.75% 2 a (4 points) Given the zero rates above what is the fair FRA rate (ACT/360)? 3.5160% 2 b (8 points) Your bank agrees a rate of 0.50% above the fair rate for your borrowing. what is the present value of your FRA? Round your answer to the nearest penny PV of Cash Flow 7,884,400 7,913,215 28,815 Days Cash Flovw Discount Factor 125 8000000 0.98555 395 -8240957.791 0.96023 Total PV-> 2 c (4 points) You do not like the rate from the bank and decide to use Eurodollar futures contracts to create an equivalent exposure. There are Eurodollar futures contracts trading with expiries every 90 days starting in 35 days. Fill out the following table with the contracts necessary to create your exposure. Contract specifications are detailed at the beginning of the exam. Expiry in Days35 125 215 305 395 485 Long or Short Number of Contracts FNCE4040-Fall2017-Final- A Initials: 2You are considering entering an FRA with your bank to borrow $8,000,000. The FRA will start in 125 days and end in 395 days. Continuously compounded interest rates are as follows. INTEREST RATES aturity Zero rate (days) | (96, cc) 125 395 4.25% 3.75% 2 a (4 points) Given the zero rates above what is the fair FRA rate (ACT/360)? 3.5160% 2 b (8 points) Your bank agrees a rate of 0.50% above the fair rate for your borrowing. what is the present value of your FRA? Round your answer to the nearest penny PV of Cash Flow 7,884,400 7,913,215 28,815 Days Cash Flovw Discount Factor 125 8000000 0.98555 395 -8240957.791 0.96023 Total PV-> 2 c (4 points) You do not like the rate from the bank and decide to use Eurodollar futures contracts to create an equivalent exposure. There are Eurodollar futures contracts trading with expiries every 90 days starting in 35 days. Fill out the following table with the contracts necessary to create your exposure. Contract specifications are detailed at the beginning of the exam. Expiry in Days35 125 215 305 395 485 Long or Short Number of Contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts