Question: Please explain the significant tax issues faced in this project during the current year. Please explain what sources will be helpful for addressing the tax

- Please explain the significant tax issues faced in this project during the current year.

- Please explain what sources will be helpful for addressing the tax issues for the client in this project.

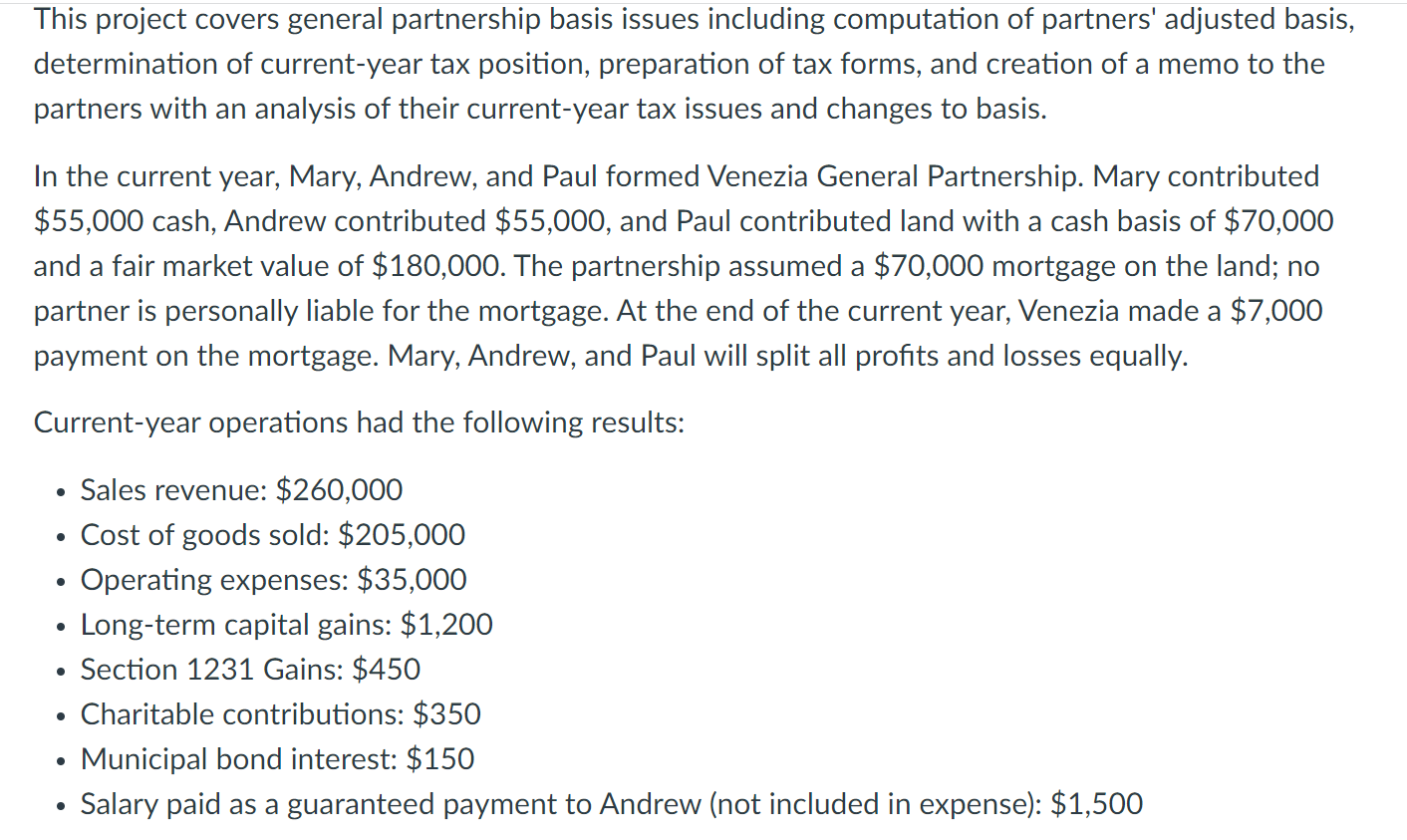

This project covers general partnership basis issues including computation of partners' adjusted basis, determination of current-year tax position, preparation of tax forms, and creation of a memo to the partners with an analysis of their current-year tax issues and changes to basis. In the current year, Mary, Andrew, and Paul formed Venezia General Partnership. Mary contributed $55,000 cash, Andrew contributed $55,000, and Paul contributed land with a cash basis of $70,000 and a fair market value of $180,000. The partnership assumed a $70,000 mortgage on the land; no partner is personally liable for the mortgage. At the end of the current year, Venezia made a $7,000 payment on the mortgage. Mary, Andrew, and Paul will split all profits and losses equally. Current-year operations had the following results: - Sales revenue: $260,000 - Cost of goods sold: $205,000 - Operating expenses: $35,000 - Long-term capital gains: \$1,200 - Section 1231 Gains: \$450 - Charitable contributions: \$350 - Municipal bond interest: \$150 - Salary paid as a guaranteed payment to Andrew (not included in expense): $1,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts