Question: please explain the step by step process so i understand for next time, thank you the question i need help on is #14 (last photo)

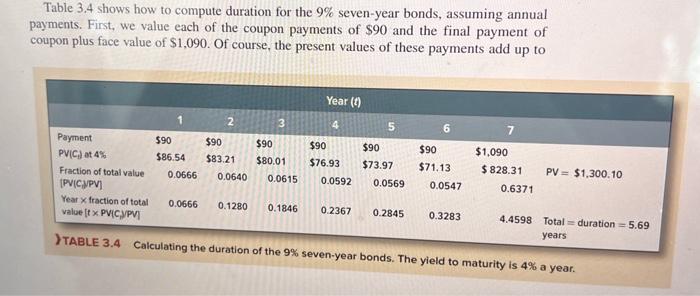

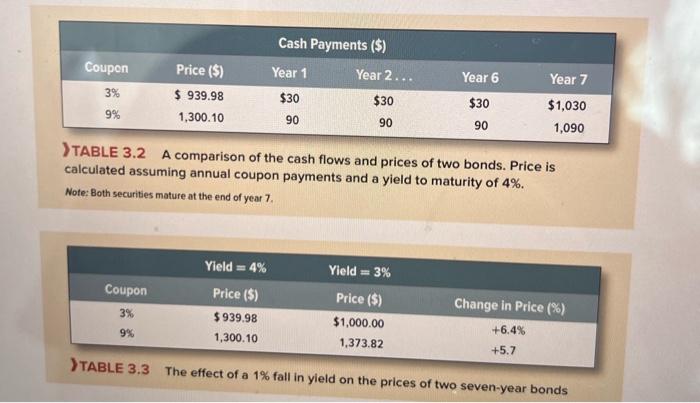

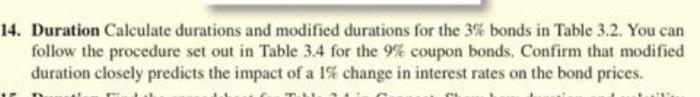

Table 3.4 shows how to compute duration for the 9% seven-year bonds, assuming annual payments. First, we value each of the coupon payments of $90 and the final payment of coupon plus face value of $1,090. Of course, the present values of these payments add up to DTABLE 3.2 A comparison of the cash flows and prices of two bonds. Price is calculated assuming annual coupon payments and a yield to maturity of 4%. Note: Both securities mature at the end of year 7 . ine errect of a 1% fall in yield on the prices of two seven-year bonds 4. Duration Calculate durations and modified durations for the 3% bonds in Table 3.2. You can follow the procedure set out in Table 3.4 for the 9% coupon bonds. Confirm that modified duration closely predicts the impact of a 1% change in interest rates on the bond prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts