Question: Please explain the steps A speculator is considering the purchase of one three month Japanese your call option with an exercise price at $5 0.0096

Please explain the steps

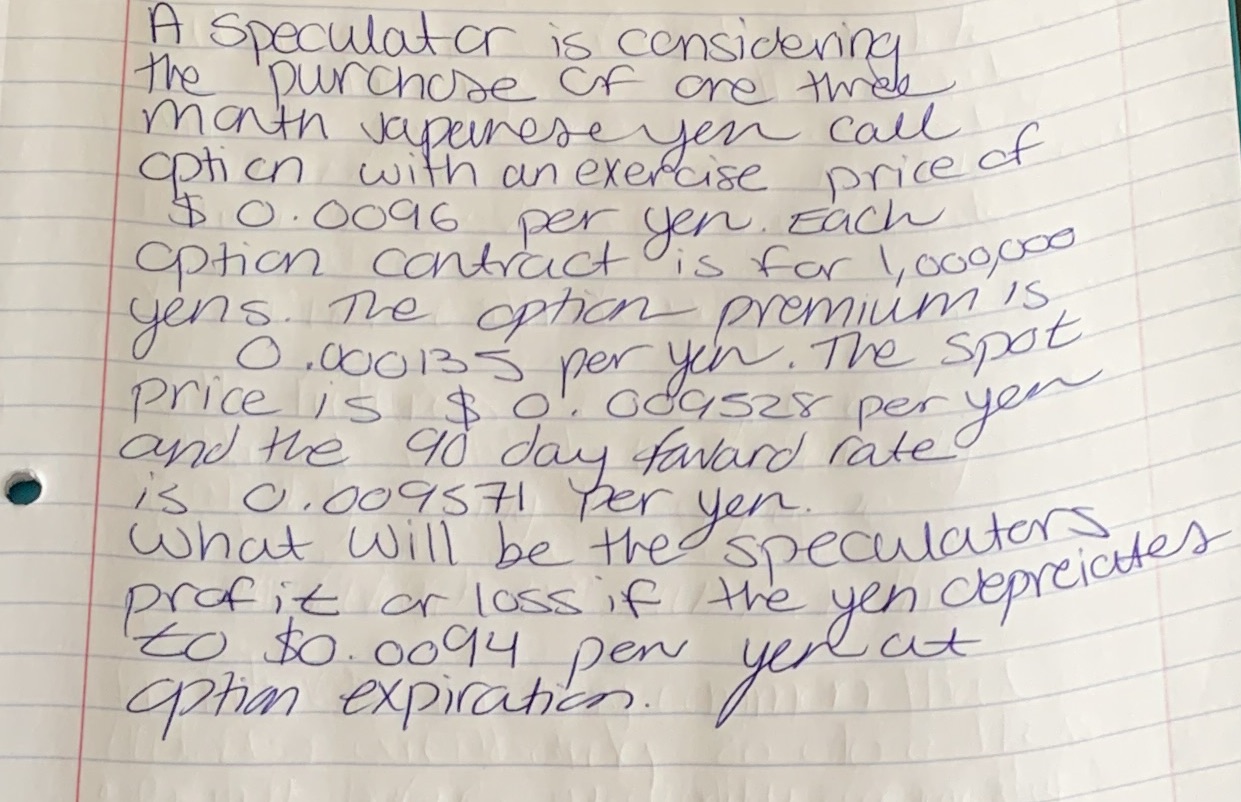

A speculator is considering the purchase of one three month Japanese your call option with an exercise price at $5 0.0096 per yen Each option contract is for 1,900,000 yens. The option premium 's 0 0OBs per you. The spot price is $ o' odas28 per year and the 90 day toward rate is 0. o095 71 per yen. what will be thespeculators profit or loss if the y yen ceprelates to $0. 004 per yere at option expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts