Question: please explain the steps in detail Suppose we have five (5) shares with a beta and expected factor yield, each, as in the table below.

please explain the steps in detail

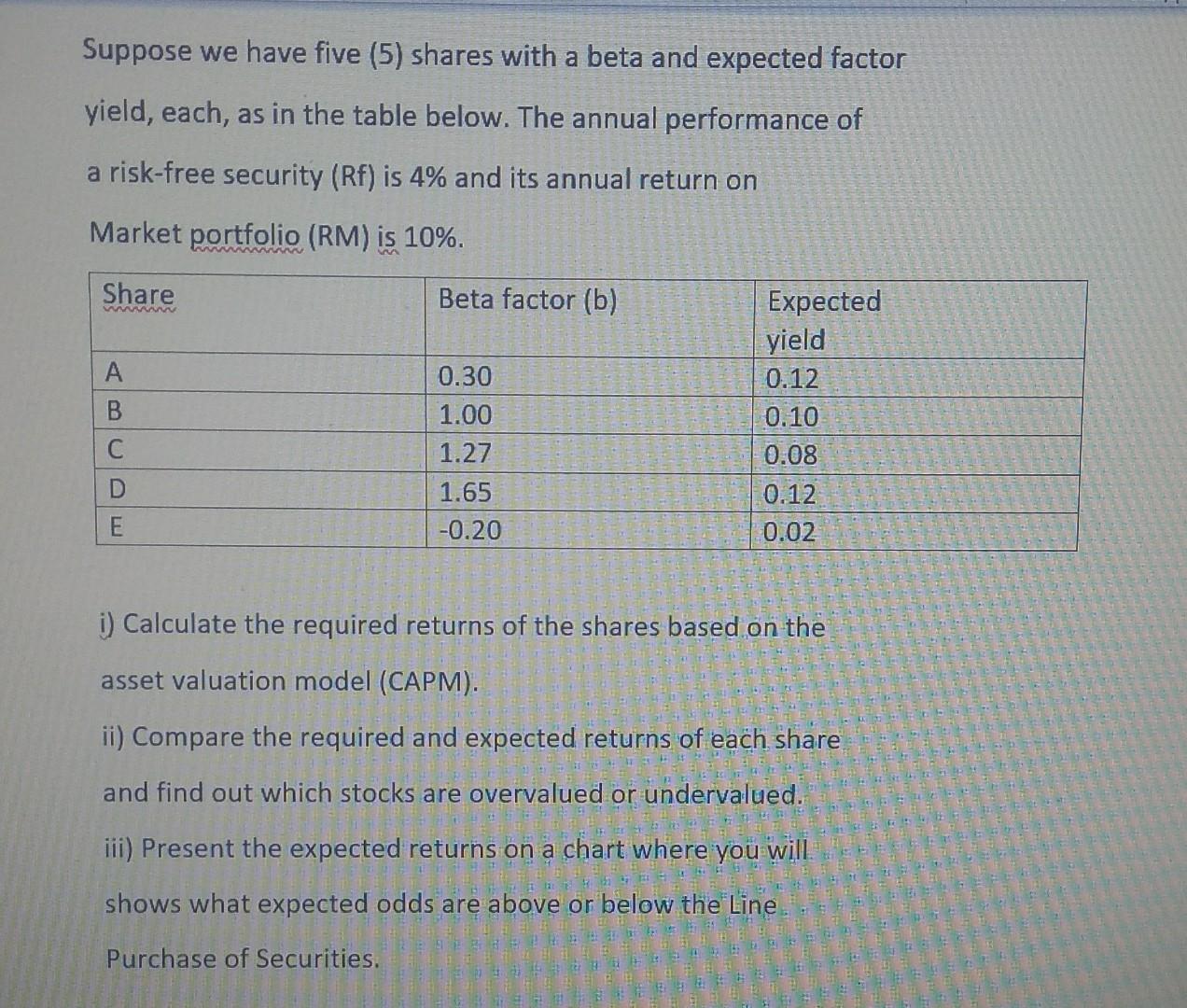

Suppose we have five (5) shares with a beta and expected factor yield, each, as in the table below. The annual performance of a risk-free security (Rf) is 4% and its annual return on Market portfolio (RM) is 10%. i) Calculate the required returns of the shares based on the asset valuation model (CAPM). ii) Compare the required and expected returns of each share and find out which stocks are overvalued or undervalued. iii) Present the expected returns on a chart where you will shows what expected odds are above or below the Line Purchase of Securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts