Question: Please explain the steps required to solve these problems. Thanks! Eddie bought a share of stock for $34.06 that paid a dividend of $1.18 and

Please explain the steps required to solve these problems. Thanks!

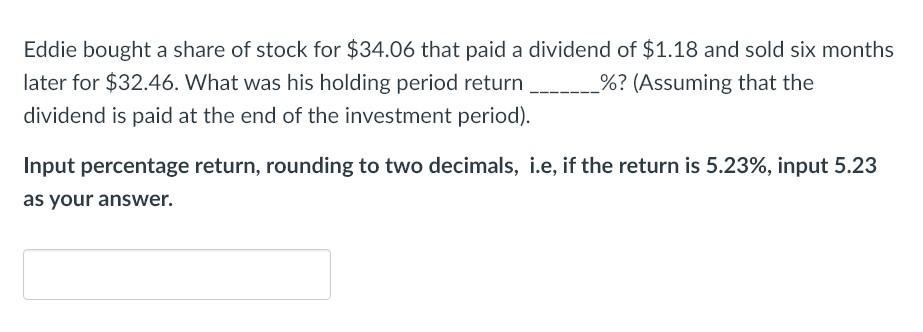

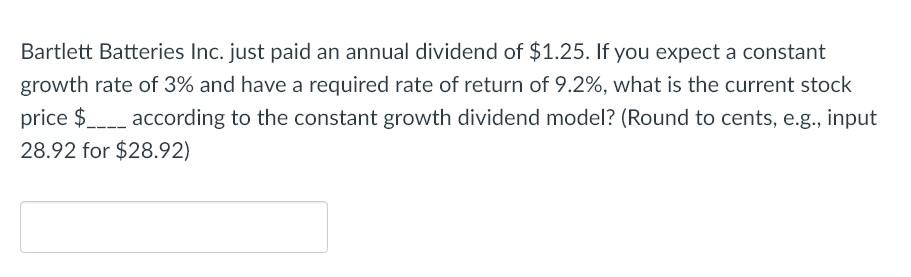

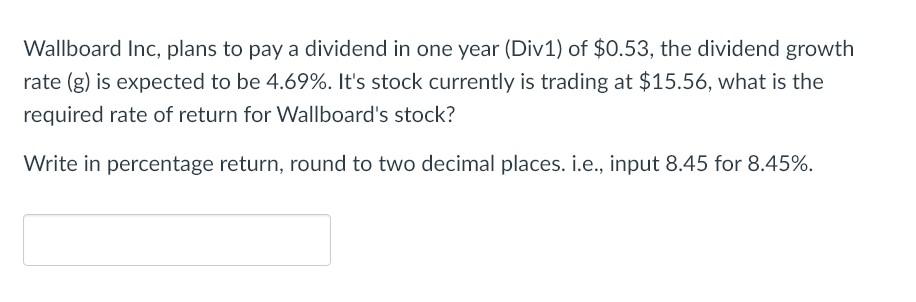

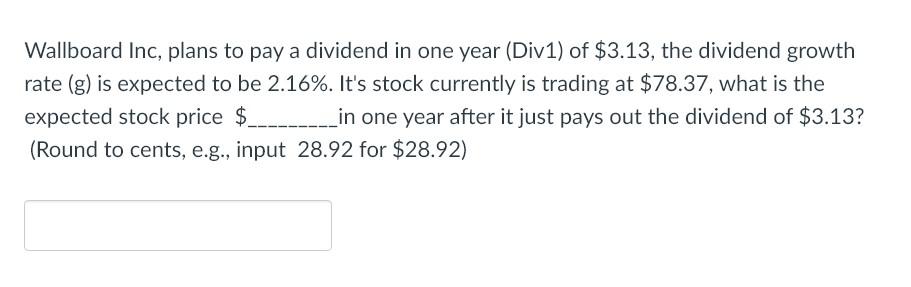

Eddie bought a share of stock for $34.06 that paid a dividend of $1.18 and sold six months later for $32.46. What was his holding period return % ? (Assuming that the dividend is paid at the end of the investment period). Input percentage return, rounding to two decimals, i.e, if the return is 5.23%, input 5.23 as your answer. Bartlett Batteries Inc. just paid an annual dividend of $1.25. If you expect a constant growth rate of 3% and have a required rate of return of 9.2%, what is the current stock price $ according to the constant growth dividend model? (Round to cents, e.g., input 28.92 for $28.92 ) Wallboard Inc, plans to pay a dividend in one year (Div1) of $0.53, the dividend growth rate (g ) is expected to be 4.69%. It's stock currently is trading at $15.56, what is the required rate of return for Wallboard's stock? Write in percentage return, round to two decimal places. i.e., input 8.45 for 8.45%. Wallboard Inc, plans to pay a dividend in one year (Div1) of $3.13, the dividend growth rate (g) is expected to be 2.16%. It's stock currently is trading at $78.37, what is the expected stock price : one year after it just pays out the dividend of $3.13 ? (Round to cents, e.g., input 28.92 for $28.92 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts