Question: Please explain the steps taken and formulas used please! Thanks in advance. Ankh-Sto Associates Co. is expected to generate a free cash flow (FCF) of

Please explain the steps taken and formulas used please! Thanks in advance.

Please explain the steps taken and formulas used please! Thanks in advance.

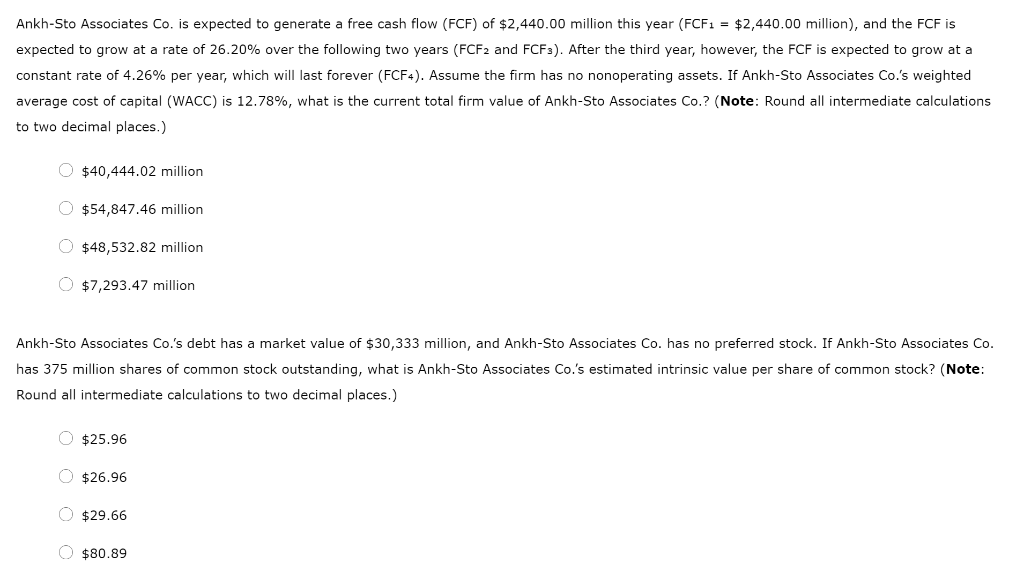

Ankh-Sto Associates Co. is expected to generate a free cash flow (FCF) of $2,440.00 million this year (FCF1 = $2,440.00 million), and the FCF is expected to grow at a rate of 26.20% over the following two years (FCF2 and FCF3). After the third year, however, the FCF is expected to grow at a constant rate of 4.26% per year, which will last forever (FCF4). Assume the firm has no nonoperating assets. If Ankh-Sto Associates Co.'s weighted average cost of capital (WACC) is 12.78%, what is the current total firm value of Ankh-Sto Associates Co.? (Note: Round all intermediate calculations to two decimal places.) $40,444.02 million $54,847.46 million $48,532.82 million $7,293.47 million Ankh-Sto Associates Co.'s debt has a market value of $30,333 million, and Ankh-Sto Associates Co. has no preferred stock. If Ankh-Sto Associates Co. has 375 million shares of common stock outstanding, what is Ankh-Sto Associates Co.'s estimated intrinsic value per share of common stock? (Note: Round all intermediate calculations to two decimal places.) $25.96 $26.96 $29.66 $80.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts