Question: Please explain the steps. Thank you so much! Assume that you have just turned 20 and are planning for your retirement. You would like to

Please explain the steps. Thank you so much!

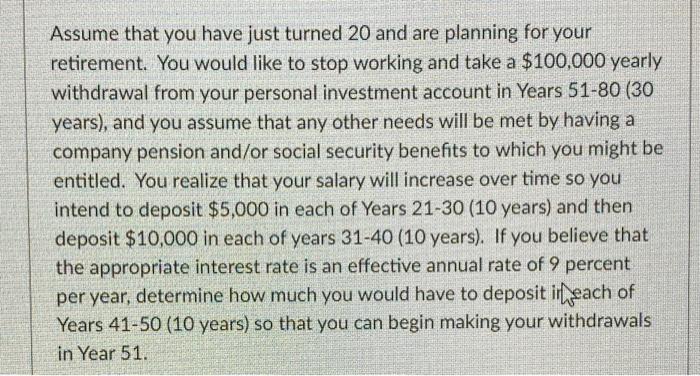

Please explain the steps. Thank you so much! Assume that you have just turned 20 and are planning for your retirement. You would like to stop working and take a $100,000 yearly withdrawal from your personal investment account in Years 51-80 (30 years), and you assume that any other needs will be met by having a company pension and/or social security benefits to which you might be entitled. You realize that your salary will increase over time so you intend to deposit $5,000 in each of Years 21-30 (10 years) and then deposit $10,000 in each of years 31-40 (10 years). If you believe that the appropriate interest rate is an effective annual rate of 9 percent per year, determine how much you would have to deposit ireach of Years 41-50 (10 years) so that you can begin making your withdrawals in Year 51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts