Question: Please explain the steps to get to the answer -thank you! TABLE 19.1 Use the information to answer following question(s) Jensen Aquatics Inc., which manufactures

Please explain the steps to get to the answer -thank you!

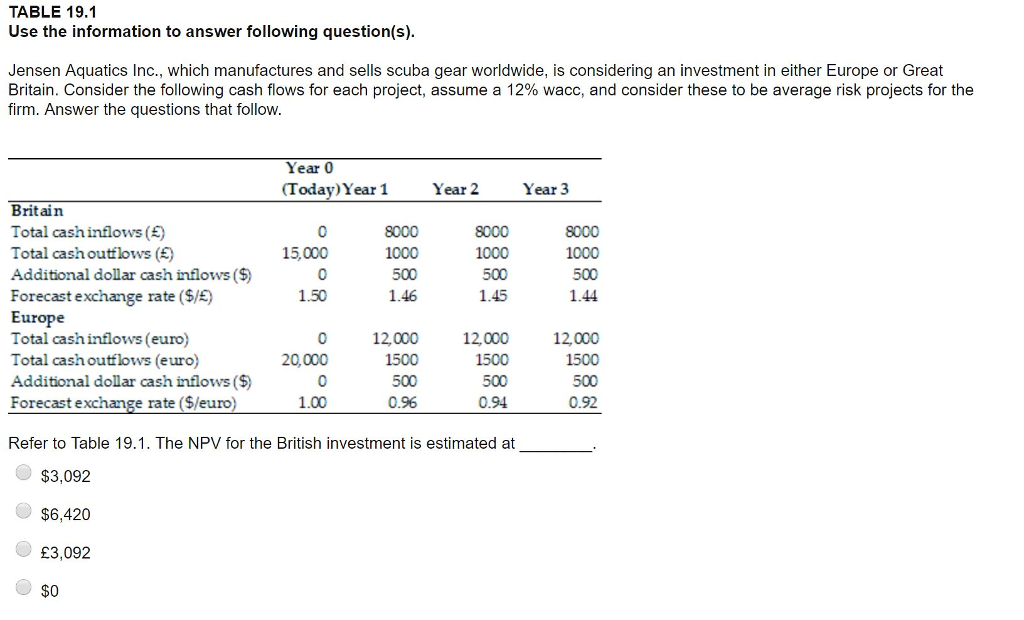

TABLE 19.1 Use the information to answer following question(s) Jensen Aquatics Inc., which manufactures and sells scuba gear worldwide, is considering an investment in either Europe or Great Britain. Consider the following cash flows for each project, assume a 12% wacc, and consider these to be average risk projects for the firm. Answer the questions that follow Year 0 (Today)Year 1 Year Year 3 Britain Total cash inflows ( Total cashoutflows () Additional dollar cash inflows () Forecast exchange rate ($/E) Europe Total cash inflows (euro) Total cash outflows (euro) Additional dollar cash inflows (S Forecast exchange rate ($/euro 0 15,000 1000 1000 1000 1.50 1.46 1.45 1.44 0 12,000 12,000 12,000 1500 500 0.92 20,000 1500 500 0.96 1500 1.00 0.94 Refer to Table 19.1. The NPV for the British investment is estimated at $3,092 $6,420 3,092 $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts