Question: Please explain the theory and step by step, thanks ! Suppose you have 100 to invest. You are planning to put a fraction w into

Please explain the theory and step by step, thanks !

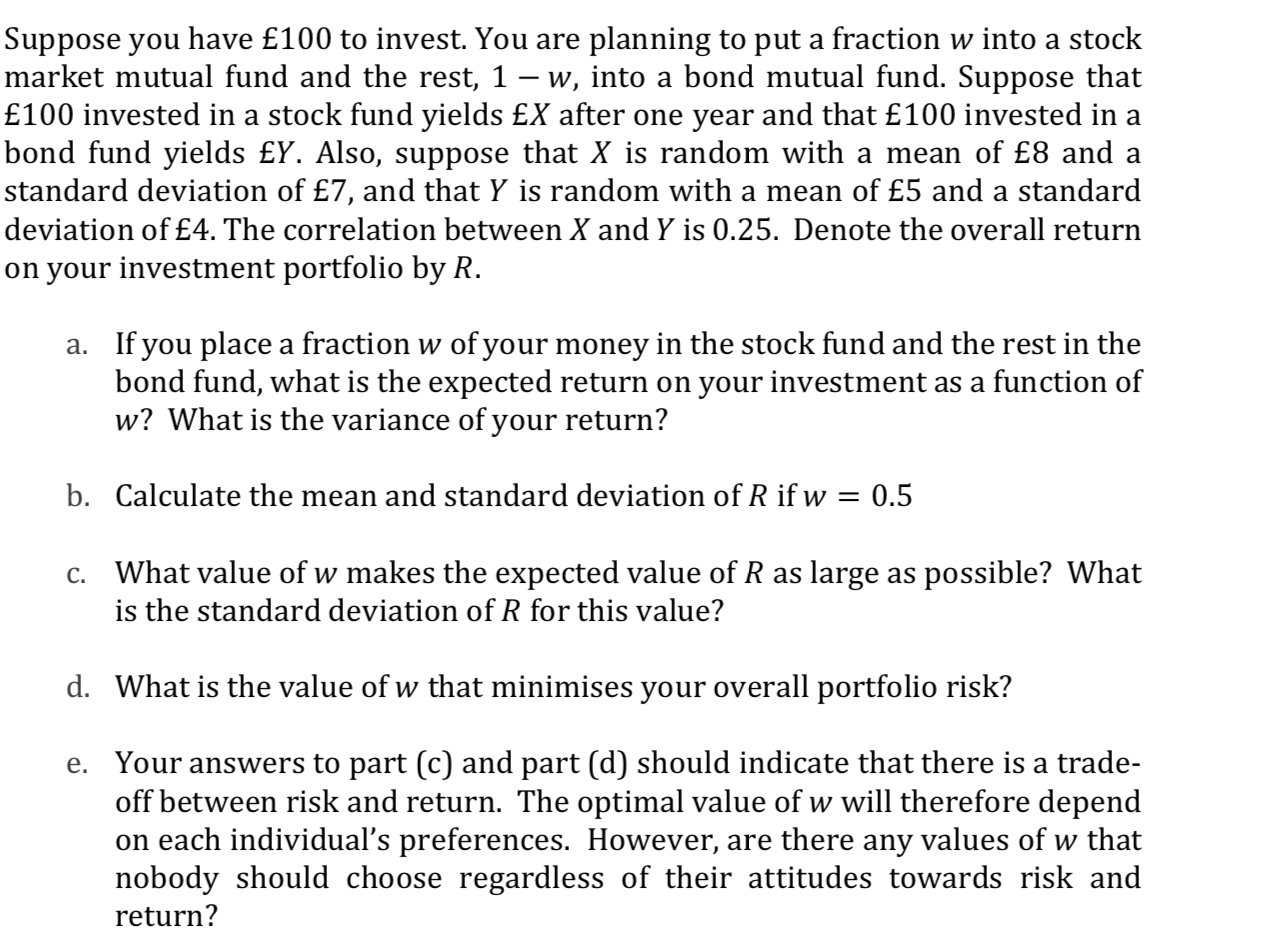

Suppose you have 100 to invest. You are planning to put a fraction w into a stock market mutual fund and the rest, 1 w, into a bond mutual fund. Suppose that 100 invested in a stock fund yields EX after one year and that 100 invested in a bond fund yields Y. Also, suppose that X is random with a mean of 8 and a standard deviation of 7, and that Y is random with a mean of 5 and a standard deviation of 4. The correlation between X and Y is 0.25. Denote the overall return on your investment portfolio by R. a. If you place a fraction w of your money in the stock fund and the rest in the bond fund, what is the expected return on your investment as a function of w? What is the variance of your return? b. Calculate the mean and standard deviation of R if w = 0.5 c. What value of w makes the expected value of R as large as possible? What is the standard deviation of R for this value? (1. What is the value of w that minimises your overall portfolio risk? e. Your answers to part (c) and part (d) should indicate that there is a trade- off between risk and return. The optimal value of w will therefore depend on each individual's preferences. However, are there any values of w that nobody should choose regardless of their attitudes towards risk and return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts