Question: Please explain the work. Thank you. Approximately Relevant ABC Silven Company has identified the following overhead activities, costs, and activity drivers for the coming year:

Please explain the work. Thank you.

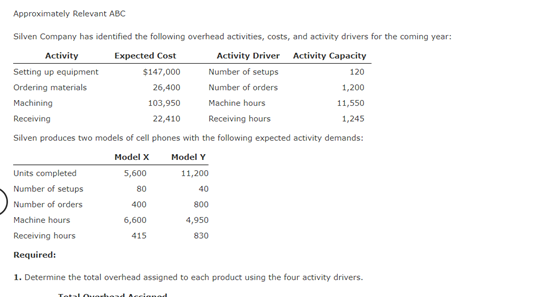

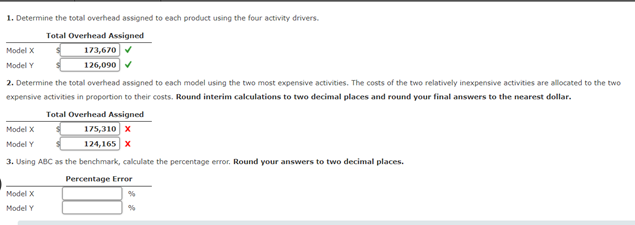

Approximately Relevant ABC Silven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity Setting up equipment $147,000 Number of setups 120 Ordering materials 26,400 Number of orders 1,200 Machining 103,950 Machine hours 11,550 Receiving 22,410 Receiving hours 1,245 Silven produces two models of cell phones with the following expected activity demands: Model X Model Y Units completed 5,600 11,200 Number of setups 80 40 Number of orders 400 800 Machine hours 6,600 4,950 Receiving hours 415 830 Required: 12 1. Determine the total overhead assigned to each product using the four activity drivers. 1. Determine the total overhead assigned to each product using the four activity drivers. Total Overhead Assigned Model X 173,670 Model Y 126,090 2. Determine the total overhead assigned to each model using the two most expensive activities. The costs of the two relatively inexpensive activities are allocated to the two expensive activities in proportion to their costs. Round interim calculations to two decimal places and round your final answers to the nearest dollar. Total Overhead Assigned Model X 175,310 X Model Y 124, 165 X 3. Using ABC as the benchmark, calculate the percentage error. Round your answers to two decimal places. Percentage Error Model X Model Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts