Question: Please explain the wrong answers Question 2 0.5 / 1 pts You own a stock currently pricedt-o at $55, the next day its pricet-1 is

Please explain the wrong answers

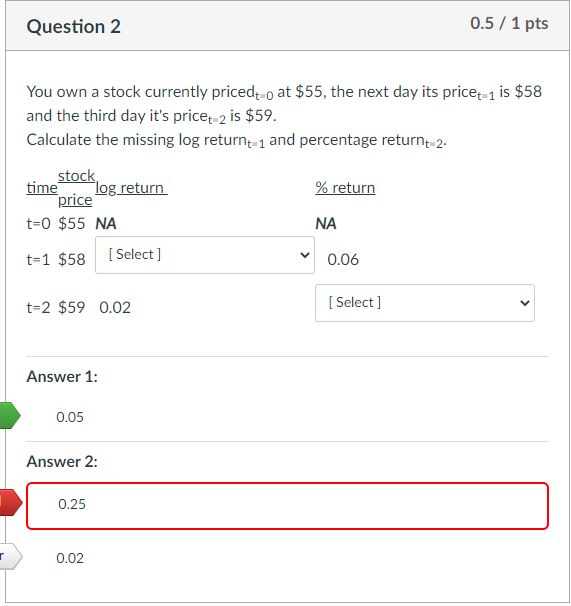

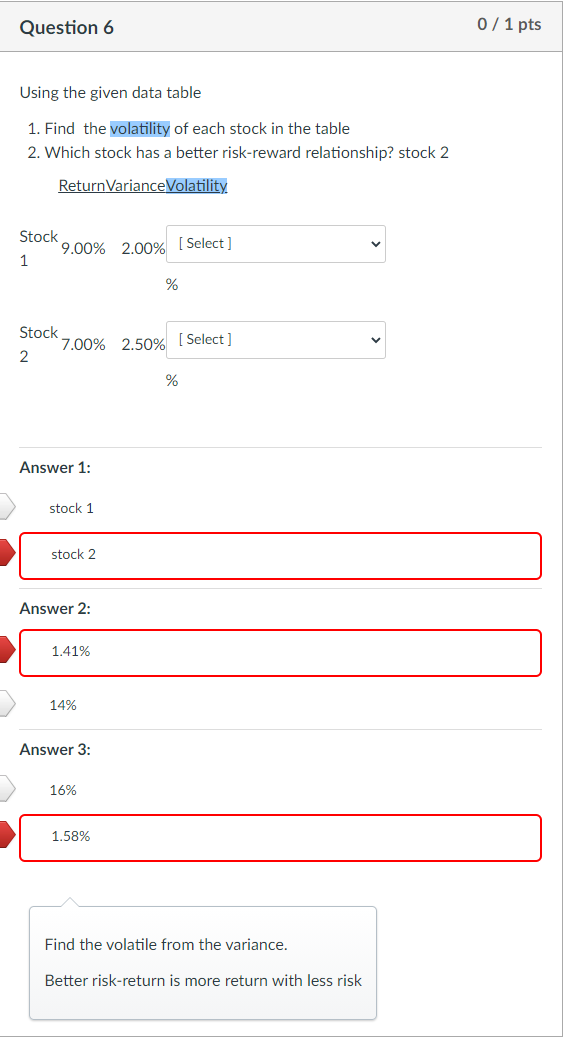

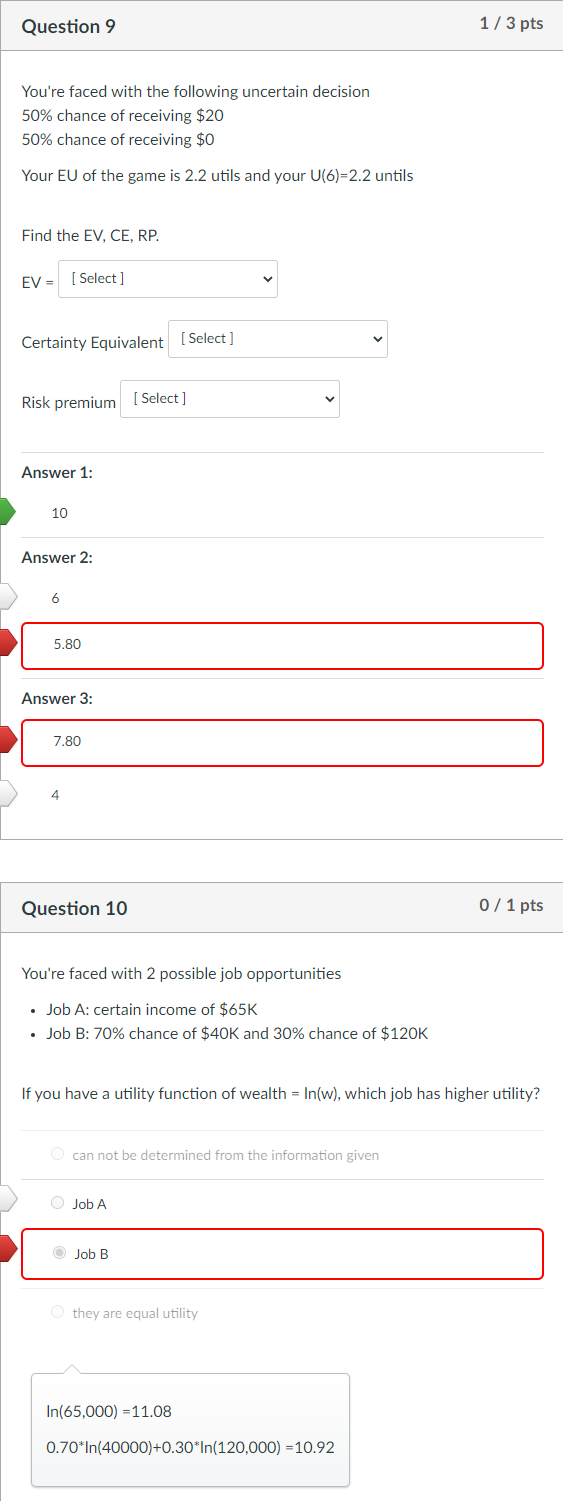

Question 2 0.5 / 1 pts You own a stock currently pricedt-o at $55, the next day its pricet-1 is $58 and the third day it's pricet-2 is $59. Calculate the missing log returnt-1 and percentage returnt-2- % return stock time log return price t=0 $55 NA t=1 $58 [Select] NA 0.06 [Select] t=2 $59 0.02 > Answer 1: 0.05 Answer 2: 0.25 0.02 Question 6 0 / 1 pts Using the given data table 1. Find the volatility of each stock in the table 2. Which stock has a better risk-reward relationship? stock 2 ReturnVariance Volatility Stock 9.00% 2.00% (Select] 1 % Stock 7.00% 2.50% [Select] 2 % Answer 1: stock 1 stock 2 Answer 2: 1.41% 14% Answer 3: 16% 1.58% Find the volatile from the variance. Better risk-return is more return with less risk Question 9 1/3 pts You're faced with the following uncertain decision 50% chance of receiving $20 50% chance of receiving $0 Your EU of the game is 2.2 utils and your U(6)=2.2 untils Find the EV, CE, RP. EV = [Select) Certainty Equivalent [Select ] Risk premium [Select] Answer 1: 10 Answer 2: 6 5.80 Answer 3: 7.80 Question 10 0 / 1 pts You're faced with 2 possible job opportunities Job A: certain income of $65K Job B: 70% chance of $40K and 30% chance of $120K If you have a utility function of wealth = In(w), which job has higher utility? can not be determined from the information given JobA Job B they are equal utility In(65,000) = 11.08 0.70*In(40000)+0.30*In(120,000) =10.92

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts