Question: please explain them in excel with FORMULAS please B E H 6 7 8 A 21) (Forward Valuation) 4 5 In August, you took a

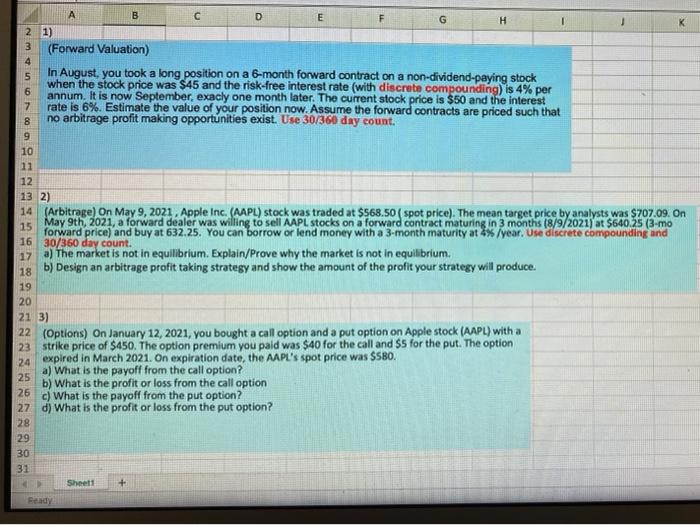

B E H 6 7 8 A 21) (Forward Valuation) 4 5 In August, you took a long position on a 6-month forward contract on a non-dividend-paying stock when the stock price was $45 and the risk-free interest rate (with discrete compounding) is 4% per annum. It is now September, exacly one month later. The current stock price is $50 and the interest rate is 6%. Estimate the value of your position now. Assume the forward contracts are priced such that no arbitrage profit making opportunities exist. Use 30/360 day count. 9 10 11 12 13 2) 14 (Arbitrage) On May 9, 2021. Apple Inc. (AAPL) stock was traded at $568.50 (spot price). The mean target price by analysts was $707.09. On 15 May 9th 2021, a forward dealer was willing to sell AAPL stocks on a forward contract maturing in 3 months (8/9/2021) at $640,25 (3-mo forward price) and buy at 632.25. You can borrow or lend money with a 3-month maturity at 4% /year. Use discrete compounding and 16 30/360 day count. 17 a) The market is not in equilibrium. Explain/Prove why the market is not in equilibrium. 18 b) Design an arbitrage profit taking strategy and show the amount of the profit your strategy will produce. 19 20 21 3) 22 (Options) On January 12, 2021, you bought a call option and a put option on Apple stock (AAPL) with a 23 strike price of $450. The option premium you paid was $40 for the call and $5 for the put. The option 24 expired in March 2021. On expiration date, the AAPL's spot price was SSBO. a) What is the payoff from the call option? 25 b) What is the profit or loss from the call option 26 c) What is the payoff from the put option? 27 d) What is the profit or loss from the put option? 28 29 30 31 Sheet1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts