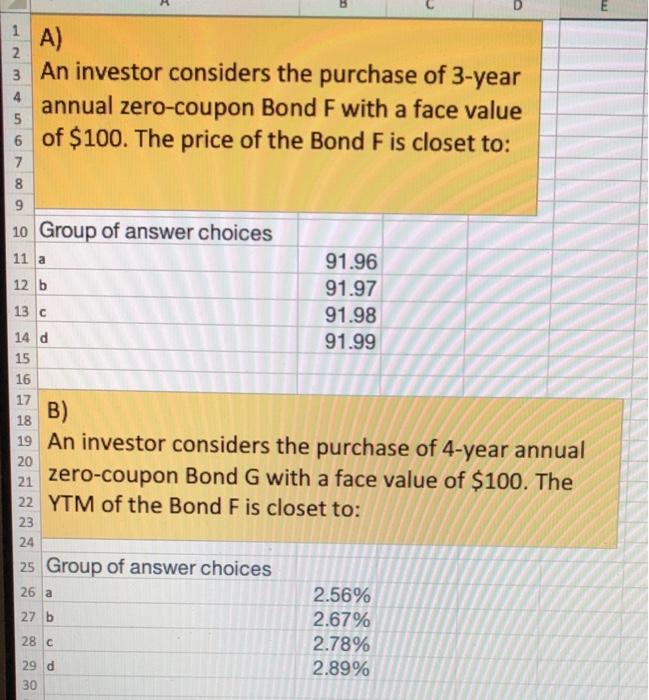

Question: please explain this in Excel with formulas given what else is needed please let me know i can update with more infomation?? its a zero

1 2 4 5 A) 3 An investor considers the purchase of 3-year annual zero-coupon Bond F with a face value 6 of $100. The price of the Bond Fis closet to: 7 8 9 10 Group of answer choices 11 a 91.96 12 b 91.97 91.98 91.99 13 C 14 d 15 16 17 18 B) 19 An investor considers the purchase of 4-year annual zero-coupon Bond G with a face value of $100. The a 22 YTM of the Bond F is closet to: 20 21 23 24 25 Group of answer choices 26 a 27 b 2.56% 2.67% 2.78% 2.89% 28 C 29 d 30 1 2 4 5 A) 3 An investor considers the purchase of 3-year annual zero-coupon Bond F with a face value 6 of $100. The price of the Bond Fis closet to: 7 8 9 10 Group of answer choices 11 a 91.96 12 b 91.97 91.98 91.99 13 C 14 d 15 16 17 18 B) 19 An investor considers the purchase of 4-year annual zero-coupon Bond G with a face value of $100. The a 22 YTM of the Bond F is closet to: 20 21 23 24 25 Group of answer choices 26 a 27 b 2.56% 2.67% 2.78% 2.89% 28 C 29 d 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts