Question: please explain this in Excel with formulas The spot discount rates for two T-bills. 80-day T-bill and 170-day T-bill, are given below. A) Based on

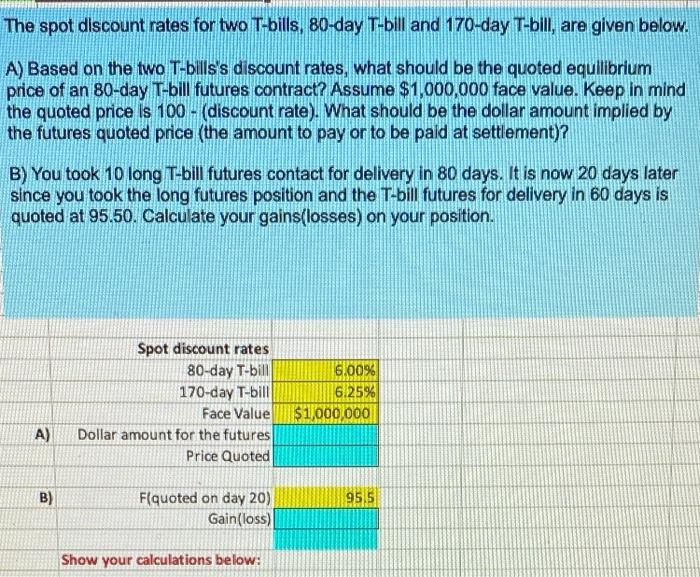

The spot discount rates for two T-bills. 80-day T-bill and 170-day T-bill, are given below. A) Based on the two T-bills's discount rates, what should be the quoted equilibrium price of an 80-day T-bill futures contract? Assume $1,000,000 face value. Keep in mind the quoted price is 100 - (discount rate). What should be the dollar amount implied by the futures quoted price (the amount to pay or to be paid at settlement)? B) You took 10 long T-bill futures contact for delivery in 80 days. It is now 20 days later since you took the long futures position and the T-bill futures for delivery in 60 days is quoted at 95.50. Calculate your gains(losses) on your position. Spot discount rates 80-day T-bill 170-day T-bill Face Value Dollar amount for the futures Price Quoted 6.00% 6.25% $1,000,000 A) B) 95.5 Flquoted on day 20) Gain(loss) Show your calculations below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts