Question: PLEASE EXPLAIN THIS SOLUTION HOW DID WE GET THE $83200? A firm is considering the purchase of a $300,000 computer-based inventory management system that would

PLEASE EXPLAIN THIS SOLUTION HOW DID WE GET THE $83200?

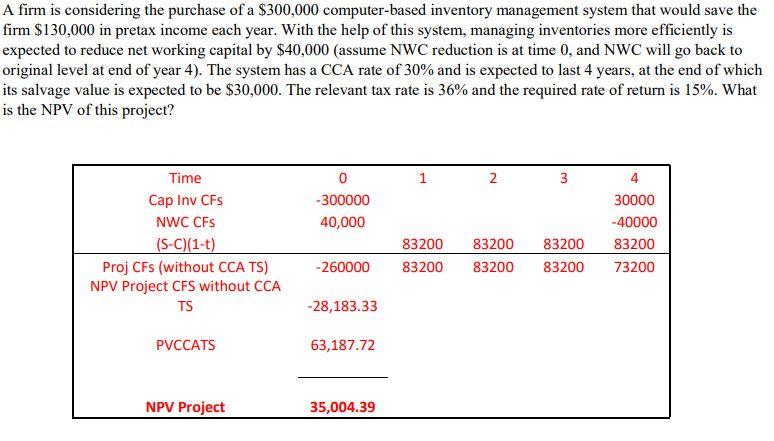

A firm is considering the purchase of a $300,000 computer-based inventory management system that would save the firm $130,000 in pretax income each year. With the help of this system, managing inventories more efficiently is expected to reduce net working capital by $40,000 (assume NWC reduction is at time 0, and NWC will go back to original level at end of year 4). The system has a CCA rate of 30% and is expected to last 4 years, at the end of which its salvage value is expected to be $30,000. The relevant tax rate is 36% and the required rate of return is 15%. What is the NPV of this project? 1 2 3 0 -300000 40,000 Time Cap Inv CFS NWC CFS (S-C)(1-t) Proj CFs (without CCA TS) NPV Project CFS without CCA 4 30000 -40000 83200 73200 83200 83200 83200 83200 83200 83200 -260000 TS -28,183.33 PVCCATS 63,187.72 NPV Project 35,004.39

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts