Question: PLEASE EXPLAIN TO ME THE THEORY BEHIND THESE NOTES. I DONT UNDERSTAND WHAT IT IS TRYING TO CONVEY :( PLEASE EXPLAIN TO ME IN A

PLEASE EXPLAIN TO ME THE THEORY BEHIND THESE NOTES. I DONT UNDERSTAND WHAT IT IS TRYING TO CONVEY :( PLEASE EXPLAIN TO ME IN A DETAIL SUMMARY WHAT THE THEORY BEHIND IT IS. (NOT THE MATH, THE THEORY). THANK YOU!!!

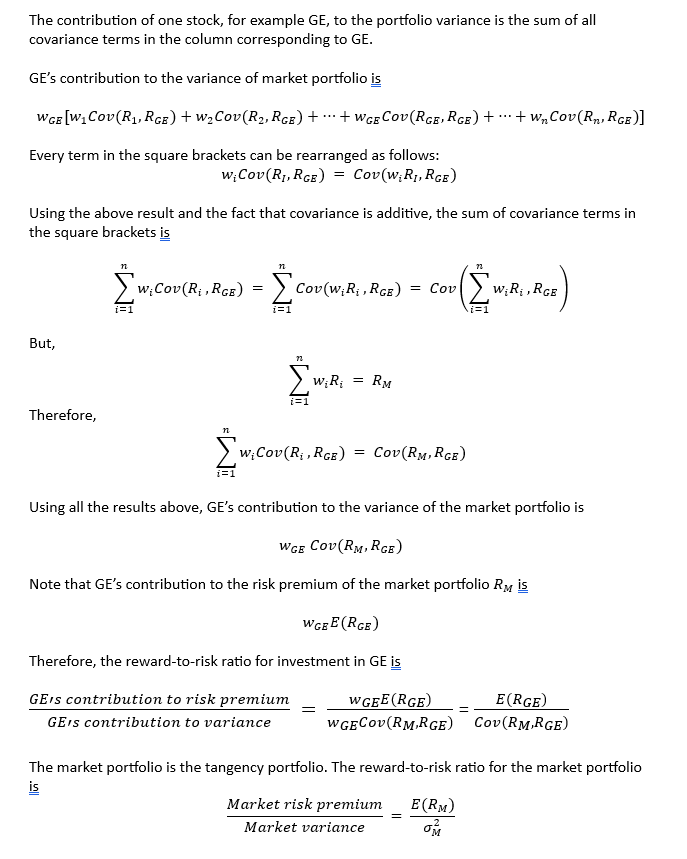

The contribution of one stock, for example GE, to the portfolio variance is the sum of all covariance terms in the column corresponding to GE. GE's contribution to the variance of market portfolio is wGE[w1Cov(R1,RGE)+w2Cov(R2,RGE)++wGECov(RGE,RGE)++wnCov(Rn,RGE)] Every term in the square brackets can be rearranged as follows: wiCov(RI,RGE)=Cov(wiRI,RGE) Using the above result and the fact that covariance is additive, the sum of covariance terms in the square brackets is i=1nwiCov(Ri,RGE)=i=1nCov(wiRi,RGE)=Cov(i=1nwiRi,RGE) But, i=1nwiRi=RM Therefore, i=1nwiCov(Ri,RGE)=Cov(RM,RGE) Using all the results above, GE's contribution to the variance of the market portfolio is wGECov(RM,RGE) Note that GE's contribution to the risk premium of the market portfolio RMis wGEE(RGE) Therefore, the reward-to-risk ratio for investment in GEis GEscontributiontovarianceGEscontributiontoriskpremium=wGECov(RM,RGE)wGEE(RGE)=Cov(RM,RGE)E(RGE) The market portfolio is the tangency portfolio. The reward-to-risk ratio for the market portfolio is MarketvarianceMarketriskpremium=M2E(RM) The above ratio is called the market price of risk. Note the following: For components of the efficient portfolio, like GE stock, we measure risk as the contribution to the portfolio variance, which depends on the covariance with the market. However, for the efficient portfolio itself, variance is the appropriate measure of risk. In equilibrium, all investments should offer the same reward-to-risk ratio. Therefore, the reward-to-risk ratio of GE and the market portfolio should be the same. Cov(RM,RGE)E(RGE)=M2E(RM) From this, the risk premium of GE is E(RGE)=M2Cov(RM,RGE)E(RM) The ratio M2Cov(RM,RGE) measures the contribution of GE stock to the variance of the market portfolio as a fraction of the total variance of the market portfolio. This ratio is called beta and is denoted by . Replacing E(rM)rf=E(RM) and E(rGE)rf=E(RGE), we can restate the above equation as E(rGE)=rf+GE[E(rMrf)] This is the well-known CAPM equation. The expected return-beta relationship tells us that the total expected return is the sum of the risk-free rate (compensation for "waiting," i.e., the time value of money) and a risk-premium (compensation for "worrying," about investment returns). If the expected return - beta relationship holds for each individual stock, it must also hold for any combination or weighted average of assets. Let there be n stocks in a portfolio. Then, the following must hold for each stock: w1E(r1)=w1rf+w11[E(rMrf)]+w2E(r2)=w2rf+w22[E(rMrf)]+=+wnE(rn)=wnrf+wnn[E(rMrf)] Adding these n equations, we have E(rP)=rf+P[E(rMrf)] where E(rp)=i=1nwiE(ri) and p=i=1nwii

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts