Question: Please explain using Excel with formulas. Enterprise Cash Flows are $100,000,000 in year 1 growing at 10% per year through year 5. Cash Flows will

Please explain using Excel with formulas.

Please explain using Excel with formulas.

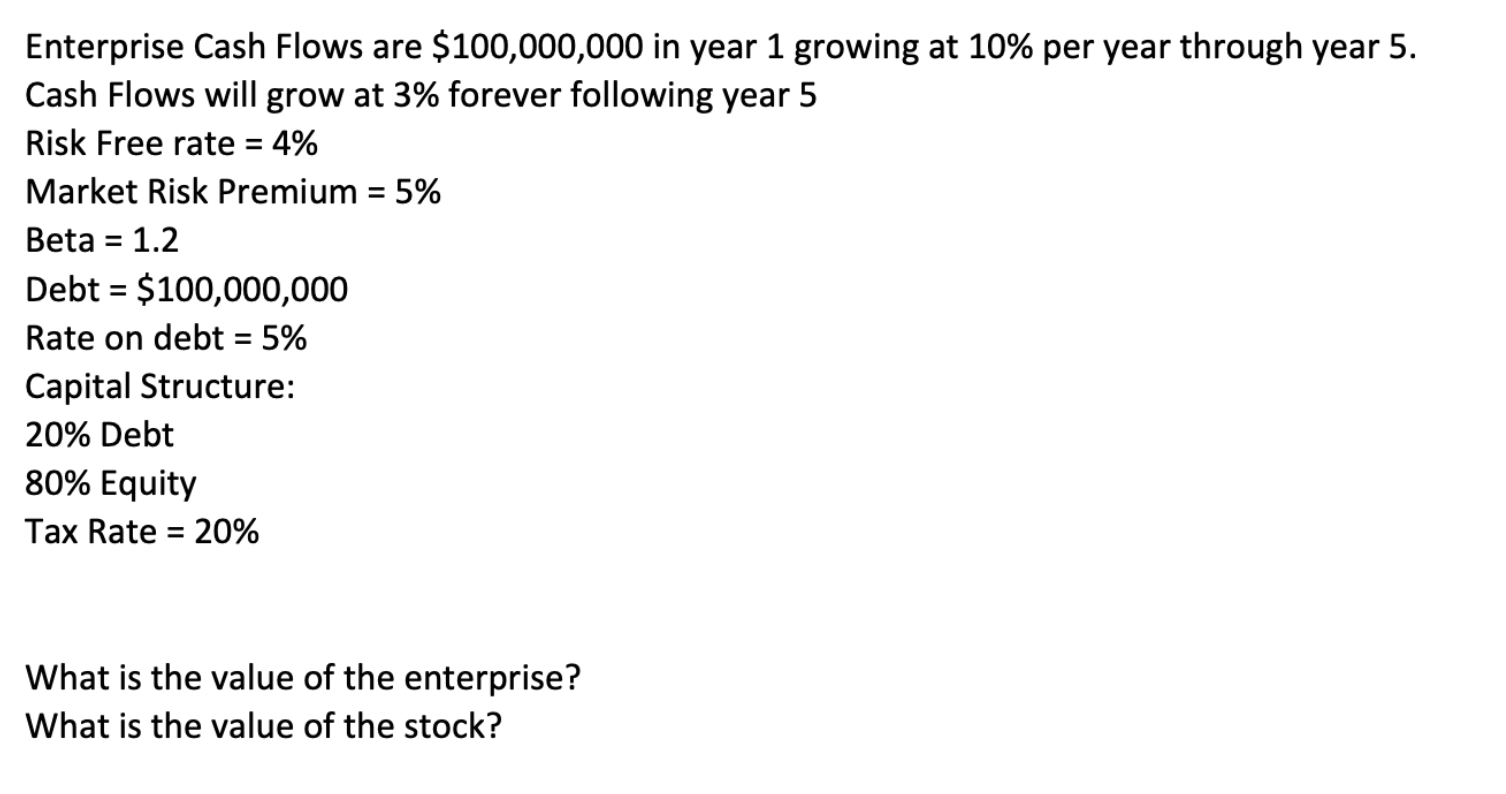

Enterprise Cash Flows are $100,000,000 in year 1 growing at 10% per year through year 5. Cash Flows will grow at 3% forever following year 5 Risk Free rate =4% Market Risk Premium =5% Beta =1.2 Debt =$100,000,000 Rate on debt =5% Capital Structure: 20% Debt 80% Equity Tax Rate =20% What is the value of the enterprise? What is the value of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts