Question: Please explain where 60 comes from and how to compute the D1 formula because I keep receiving .88 1. IBM stock currently sells for 70

Please explain where 60 comes from and how to compute the D1 formula because I keep receiving .88

Please explain where 60 comes from and how to compute the D1 formula because I keep receiving .88

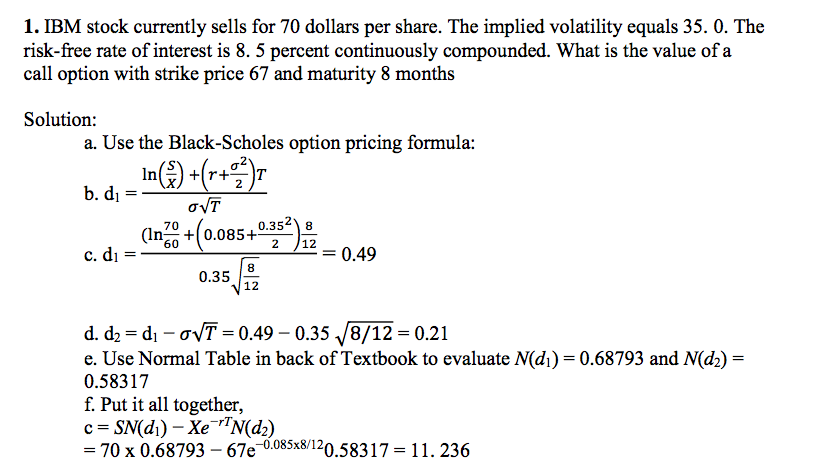

1. IBM stock currently sells for 70 dollars per share. The implied volatility equals 35. 0. The risk-free rate of interest is 8. 5 percent continuously compounded. What is the value of a call option with strike price 67 and maturity 8 months Solution a. Use the Black-Scholes option pricing formula: 2 (ln0+(0.085+0.3548 0.35 12 70 2 120.49 8 T-0.49-0.35Te/1201 to evaluate N(di)-0.68793 and N(d) e. Use Normal Table in back of Textbook to evaluate N(d) = 0.68793 and N(d) = 0.58317 f. Put it all together, = 70 x 0.68793-67e-0.085x8/120.583 17-11. 236

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts