Question: please explain where do those numbers that I highlight come from(why is tax base different from carrying amount)? And why? Thomas Ltd uses the revaluation

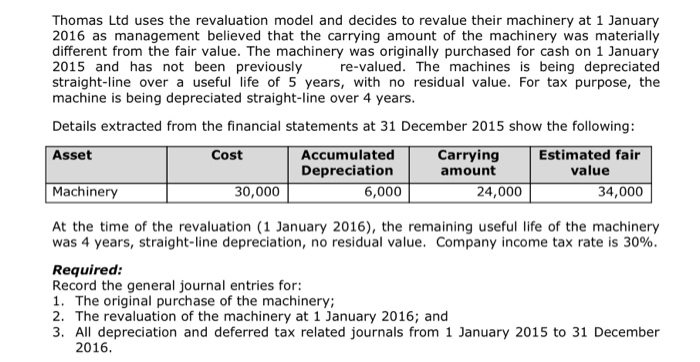

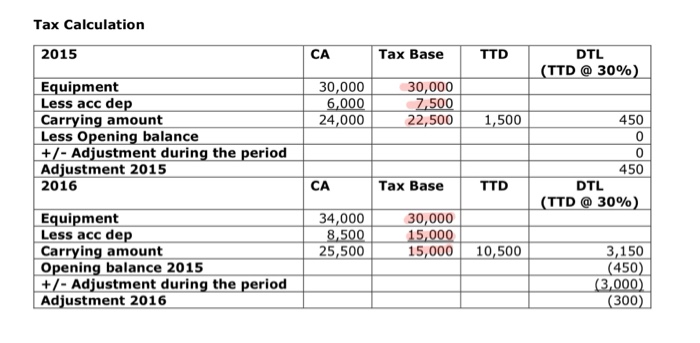

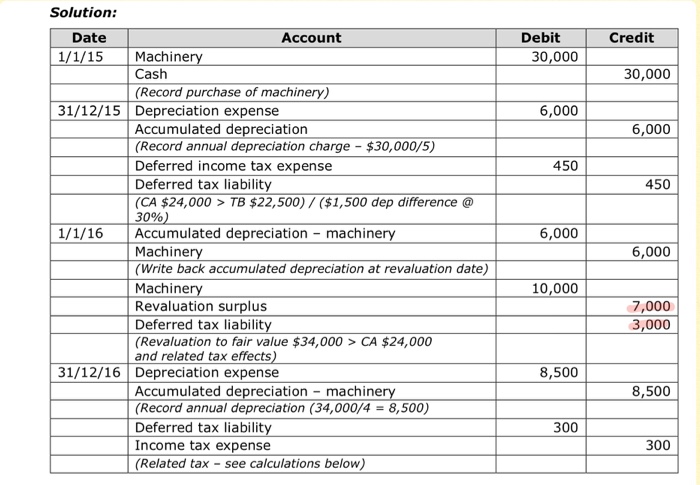

Thomas Ltd uses the revaluation model and decides to revalue their machinery at 1 January 2016 as management believed that the carrying amount of the machinery was materially different from the fair value. The machinery was originally purchased for cash on 1 January 2015 and has not been previously straight-line over a useful life of 5 years, with no residual value. For tax purpose, the machine is being depreciated straight-line over 4 years. re-valued. The machines is being depreciated Details extracted from the financial statements at 31 December 2015 show the following: Carrying amount Cost Accumulated Depreciation Estimated fair value Asset Machinery 30,000 6,000 24,000 34,000 At the time of the revaluation (1 January 2016), the remaining useful life of the machinery was 4 years, straight-line depreciation, no residual value. Company income tax rate is 30%. Required: Record the general journal entries for: 1. The original purchase of the machinery; 2. The revaluation of the machinery at 1 January 2016; and 3. All depreciation and deferred tax related journals from 1 January 2015 to 31 December 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts