Question: please explain where the numbers 100, .6, and .4 come from. As well as 80 for part B. I understand how to do the math,

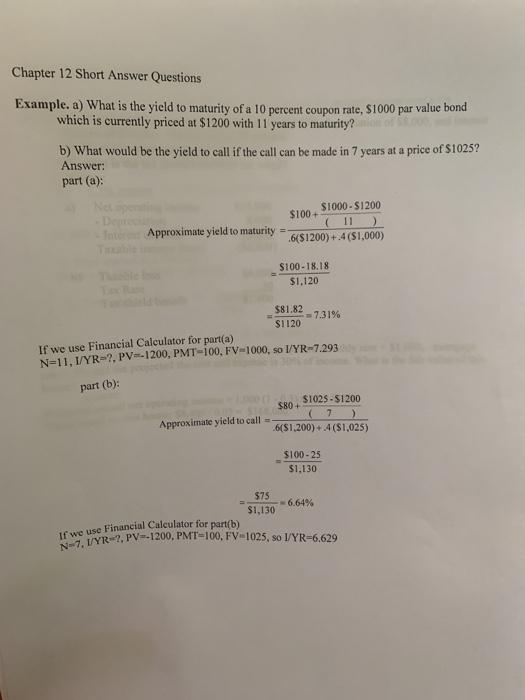

Chapter 12 Short Answer Questions Example. a) What is the yield to maturity of a 10 percent coupon rate, 51000 par value bond which is currently priced at $1200 with 11 years to maturity? b) What would be the yield to call if the call can be made in 7 years at a price of S1025? Answer: part (a): S1000-S1200 $100+ ( 11 ) .6(S1200)+.4 (S1,000) Approximate yield to matu $100-18.18 S1,120 $81.82 7.31% $1120 If we use Financial Calculator for part(a) N=11, 1/YRO?, PV--1200, PMT-100, FV-1000, so I/YR-7.293 part (b): $1025 - $1200 $80+ (7) Approximate yield to call = 6($1.200)+4($1,025) $100-25 $1,130 $75 6.64% $1,130 If we use Financial Calculator for part(b) N-7, I/YR. PV-1200, PMT=100, FV-1025, so I/YR-6,629

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts