Question: please explain why Consider the case where implied volatility increases as an option moves away from the money and the implied volatility takes the lowest

please explain why

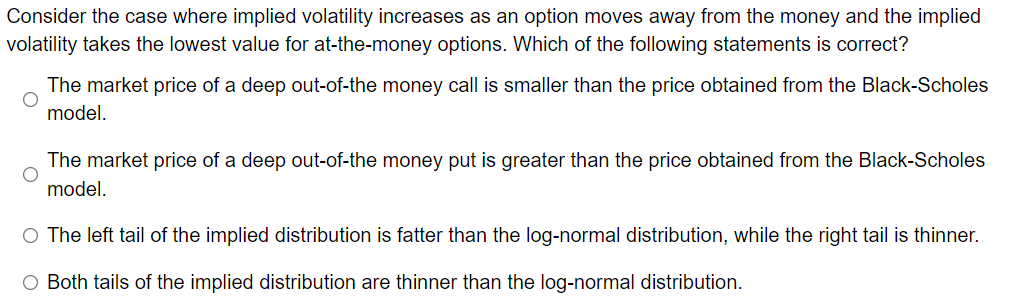

Consider the case where implied volatility increases as an option moves away from the money and the implied volatility takes the lowest value for at-the-money options. Which of the following statements is correct? The market price of a deep out-of-the money call is smaller than the price obtained from the Black-Scholes model. O The market price of a deep out-of-the money put is greater than the price obtained from the Black-Scholes model. The left tail of the implied distribution is fatter than the log-normal distribution, while the right tail is thinner. O Both tails of the implied distribution are thinner than the log-normal distribution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts