Question: ****please explain why each one is correct Question 16 A 10 year bond with a coupon of $80 and a principal due at maturity of

****please explain why each one is correct

****please explain why each one is correct

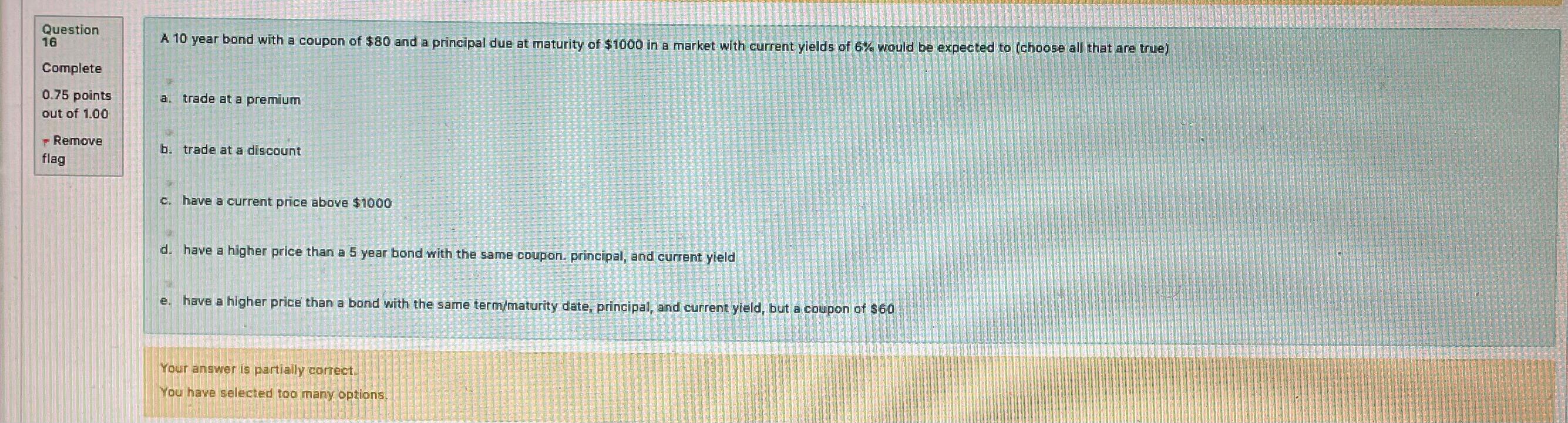

Question 16 A 10 year bond with a coupon of $80 and a principal due at maturity of $1000 in a market with current yields of 6% would be expected to (choose all that are true) Complete 0.75 points a. trade at a premium out of 1.00 Remove b. trade at a discount flag c. have a current price above $1000 d. have a higher price than a 5 year bond with the same coupon principal, and current yield e. have a higher price than a bond with the same term/maturity date, principal, and current yield, but a coupon of $60 Your answer is partially correct. You have selected too many options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts