Question: Please explain why how they got these answers, and the reasoning behind it. I want to understand the concept Analyzing Accrual Accounting Adjustments The following

Please explain why how they got these answers, and the reasoning behind it. I want to understand the concept

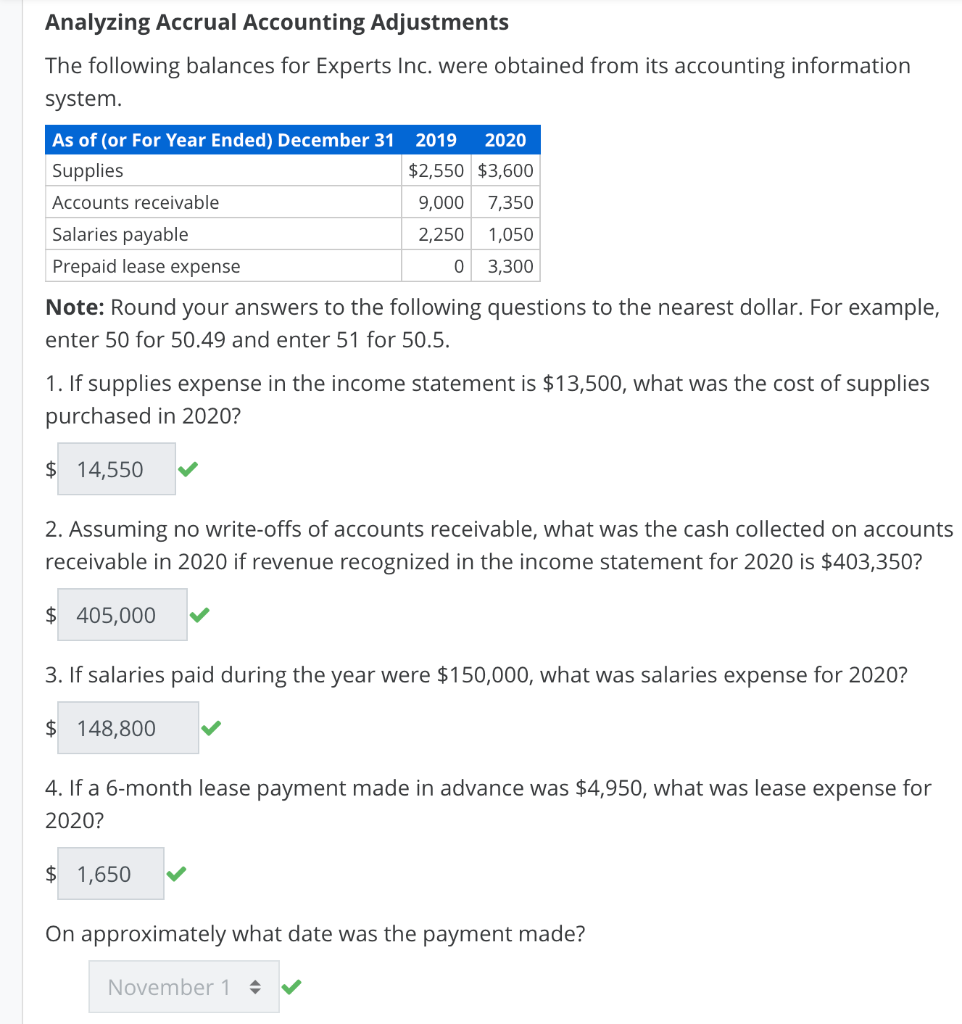

Analyzing Accrual Accounting Adjustments The following balances for Experts Inc. were obtained from its accounting information system. As of (or For Year Ended) December 31 Supplies Accounts receivable Salaries payable Prepaid lease expense 2019 2020 $2,550 $3,600 9,000 7,350 2,250 1,050 0 3,300 Note: Round your answers to the following questions to the nearest dollar. For example, enter 50 for 50.49 and enter 51 for 50.5. 1. If supplies expense in the income statement is $13,500, what was the cost of supplies purchased in 2020? $ 14,550 2. Assuming no write-offs of accounts receivable, what was the cash collected on accounts receivable in 2020 if revenue recognized in the income statement for 2020 is $403,350? $ 405,000 3. If salaries paid during the year were $150,000, what was salaries expense for 2020? $ 148,800 4. If a 6-month lease payment made in advance was $4,950, what was lease expense for 2020? $ 1,650 On approximately what date was the payment made? November 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts