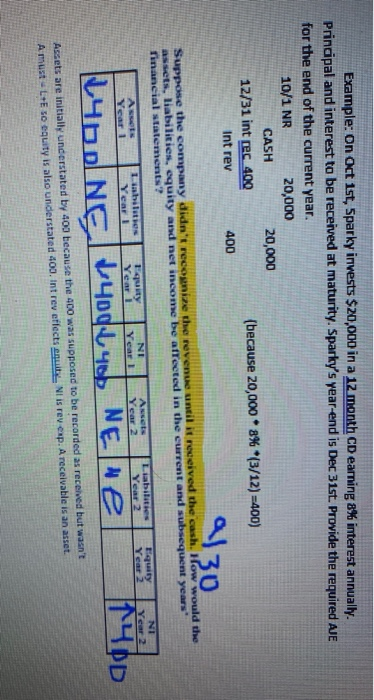

Question: please explain why in year 2 there is no effect on assets liabilities or equity but an overstatement of $400 Example: On Oct 1st, Sparky

please explain why in year 2 there is no effect on assets liabilities or equity but an overstatement of $400

please explain why in year 2 there is no effect on assets liabilities or equity but an overstatement of $400Example: On Oct 1st, Sparky invests $20,000 in a 12 month CD earning 8% interest annually. Principal and interest to be received at maturity. Sparky's year-end is Dec 31st. Provide the required AJE for the end of the current year. 10/1 NR 2 0,000 CASH 20,000 12/31 int rec 400 (because 20,000 8% *(3/12) -400) Int rev 400 a would the Suppose the company didn't reconize the revenue until it received the cash. How would the assets, liabilities, equity and net income be a Tected in the current and subsequent years financial statements? Year 2 Year 2 Year 2 Year 2 Year 2 Part Year 145N Year Year 4d U40) NE ne 1400 Assets are initially understated by 400 because the 400 was supposed to be recorded as received but wasn't Amust LEO equity is also understated 400. Int rev effects enu . Niis rev exp. A receivable is an asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts