Question: Please explain why is $40 debited at year end AND at the maturity date? Overall that would give the company $140 (60+40+40) on the books

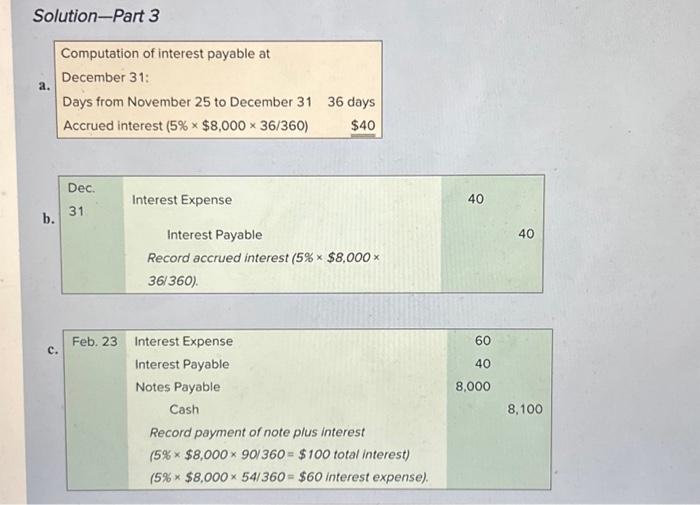

Part 3. On November 25 of the current year, a company borrows $8,000 cash by signing a 90 -day, 5% note payable with a face value of $8,000. (a) Compute the accrued interest payable on December 31 of the current year, (b) prepare the journal entry to record the acerued interest expense at December 31 of the current year, and (c) prepare the journal entry to record payment of the note at maturity. Solution-Part 3 Computation of interest payable at a. December 31 : Days from November 25 to December 3136 days Accrued interest (5%$8,00036/360)$40 b. c. Feb. 23 Interest Expense Interest Payable Notes Payable Cash Record payment of note plus interest (5%$8,00090/360=$100 total interest ) (5%$8,00054/360=$60 interest expense)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts