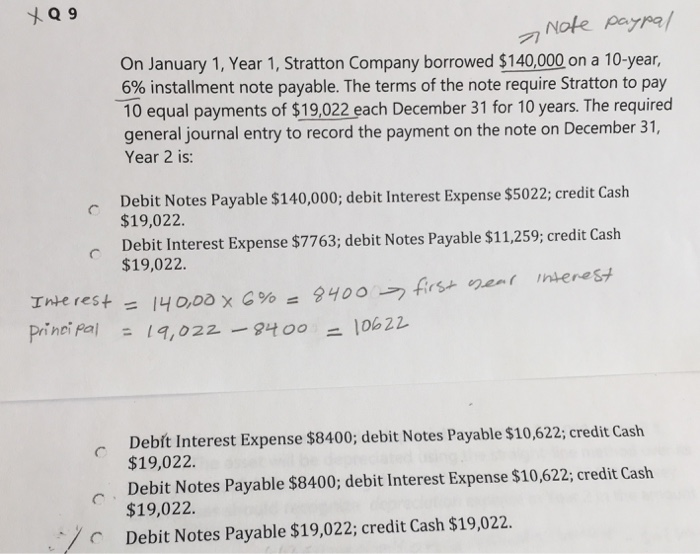

Question: Please explain why Note payp/ On January 1, Year 1, Stratton Company borrowed $140,000 on a 10-year, 6% installment note payable. The terms of the

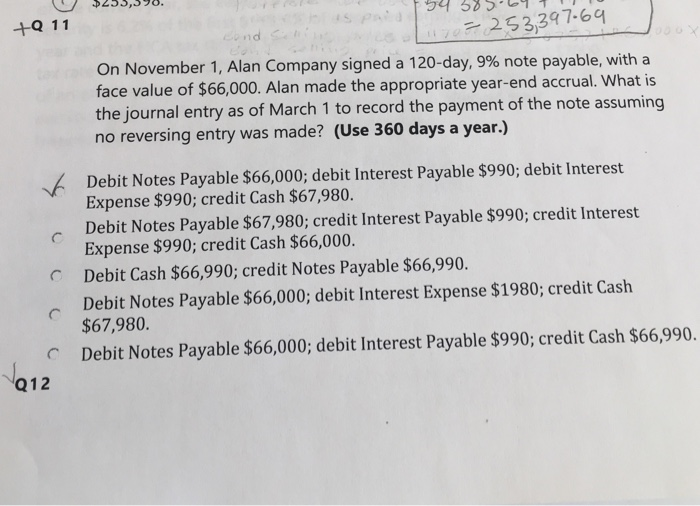

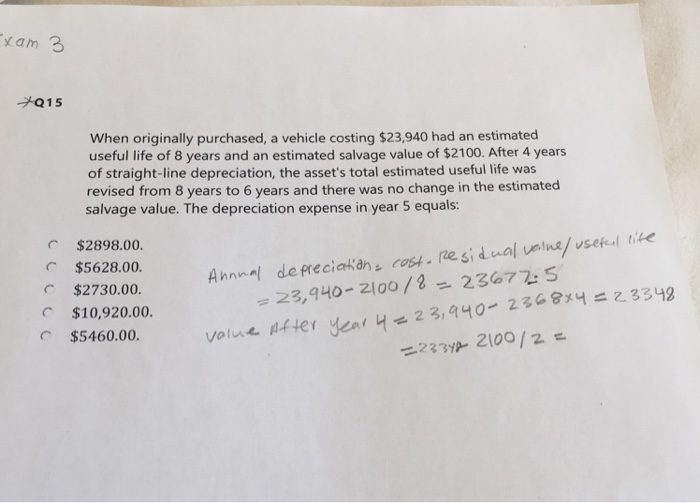

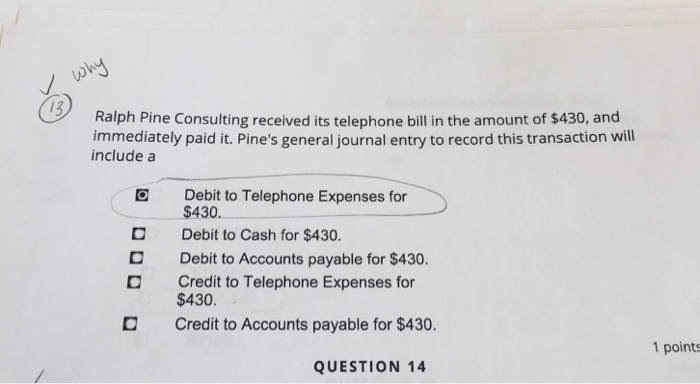

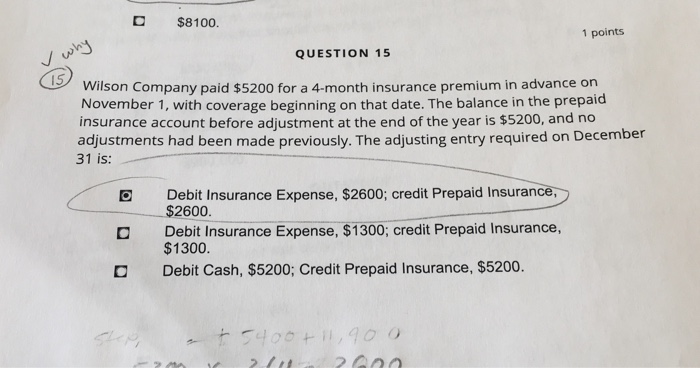

Note payp/ On January 1, Year 1, Stratton Company borrowed $140,000 on a 10-year, 6% installment note payable. The terms of the note require Stratton to pay 10 equal payments of $19,022 each December 31 for 10 years. The required general journal entry to record the payment on the note on December 31, Year 2 is Debit Notes Payable $140,000, debit Interest Expense $5022; credit Cash $19,022 Debit Interest Expense $7763; debit Notes Payable $11,259; credit Cash $19,022. c c Princi pal1,022-9t10b22 Debit Interest Expense $8400; debit Notes Payable $10,622; credit Cash $19,022. Debit Notes Payable $8400; debit Interest Expense $10,622; credit Cash $19,022. Debit Notes Payable $19,022; credit Cash $19,022. $253,390 +Q 11 253397-69 On November 1, Alan Company signed a 120-day, 9% note payable, with a face value of $66,000. Alan made the appropriate year-end accrual. What is the journal entry as of March 1 to record the payment of the note assuming no reversing entry was made? (Use 360 days a year.) Debit Notes Payable $66,000; debit Interest Payable $990; debit Interest Expense $990; credit Cash $67,980. Debit Notes Payable $67,980; credit Interest Payable $990; credit Interest Expense $990; credit Cash $66,000. Debit Cash $66,990; credit Notes Payable $66,990. Debit Notes Payable $66,000; debit Interest Expense $1980; credit Cash $67,980. C Debit Notes Payable $66,000; debit Interest Payable $990; credit Cash $66,990. Q12 am 3 015 When originally purchased, a vehicle costing $23,940 had an estimated useful life of 8 years and an estimated salvage value of $2100. After 4 years of straight-line depreciation, the asset's total estimated useful life was revised from 8 years to 6 years and there was no change in the estimated aaaThe depreciation exp in year 5 equals. $2898.00. $5628.00. $2730.00. Annnal de preciakansros.rne si dual vna vsefl tite $10,920.00 $5460.00. 236725 3,940-zioo /8 = volue nter yey2 3,440 233342 Ralph Pine Consulting received its telephone bill in the amount of $430, and immediately paid it. Pine's general journal entry to record this transaction will include a Debit to Telephone Expenses for $430. C Debit to Cash for $430. D Debit to Accounts payable for $430. Credit to Telephone Expenses for $430. C Credit to Accounts payable for $430. 1 points QUESTION 14 $8100. why 5Wilson Company paid $5200 for a 4-month insurance premium in advance on 1 points QUESTION 15 November 1, with coverage beginning on that date. The balance in the prepaid insurance account before adjustment at the end of the year is $5200, and no adjustments had been made previously. The adjusting entry required on December 31 is: O Debit Insurance Expense, $2600; credit Prepaid Insurance, $2600 pense, 52600, redt Prepaid Insurance, d Debit Insurance Expense, $1300; credit Prepaid Insurance, $1300. Debit Cash, $5200; Credit Prepaid Insurance, $5200. D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts